Supply of Goods with Installation Services- Composite Supply or Independent Supply?

In an Application filed before AAR, Karnataka by M/S. Bharat Earth Movers Limited, (BEML)

Table of Contents

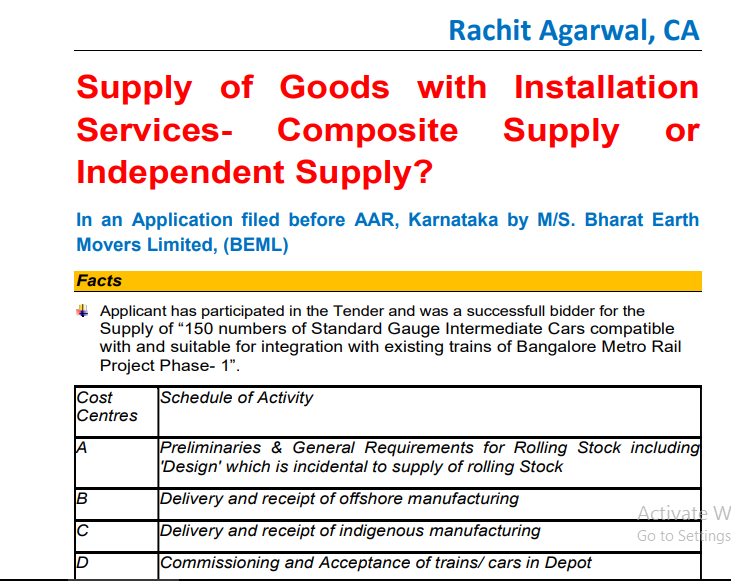

Facts:

The applicant has participated in the Tender and was a successful bidder for the Supply of “150 numbers of Standard Gauge Intermediate Cars compatible with and suitable for integration with existing trains of Bangalore Metro Rail Project Phase- 1”.

| Cost Centres | Schedule of Activity |

| A | Preliminaries & General Requirements for Rolling Stock including ‘Design’ which is incidental to supply of rolling Stock |

| B | Delivery and receipt of offshore manufacturing |

| C | Delivery and receipt of indigenous manufacturing |

| D | Commissioning and Acceptance of trains/ cars in Depot |

| E | Taking over of unit/train for revenue services |

| F | Deleted |

| G | Supply of Unit Exchange spares, mandatory spares and consumable spares and special tools testing and diagnostic equipment |

| H | Training, Operation and Maintenance Manuals (Optional) which is incidental but integral part of the Supply Contract. |

The broad scope of activity to be undertaken by the applicant was to manufacture and supply the Standard Gauge Intermediate Cars along with the installation and commissioning of the cars supplied, including training, supervision of maintenance, supply of spares, preparation of manuals etc.

Each Cost Centres are separately stipulated in the Contract and milestones have been identified for raising invoices for individual supplies.

The applicant states that the supply of goods and services from cost centers should be treated as independent supplies

The applicant submitted that the contract categorically stipulates that the scope of each of the cost centres are independent of each other and the obligations and responsibilities of each of the Cost Centres should be based on their independent scope of works.

The contract specifies individual milestones, timeframe for completion of the milestone vis-a-vis the cost apportioned against each milestone.

The Applicant makes the supplies based on the timelines and the milestones as agreed and accordingly raises the invoices.

Applicant reiterates that as per the contract entered into with BMRCL, the separate scope of work has been identified and separate values have been apportioned to different Cost Centres of the applicant

Applicant relied on

1. In Re: Kalyan Toll Infrastructure Ltd. 2020 (32) G.S.T.L. 288 (A.A.R. – GST – M.P.)

2. Randox Laboratories India Private Limited 2020 (32) G.S. T.L. 261 (A.A.R. – GST – Kar.),

3. Keysight Technologies International India Pvt. Ltd. 2020 (32) G.S.T.L. 126 (A.A.R. – GST – Haryana),

4. Deepak & Co 2018 (13) GSTL 382 (AAR-GST),

5. Vista Marine And Hydraulics 2019 (30) G.S.T.L. 671 (A.A.R. GST)

AAR Order:

Total Contract Price is split up into separate Contract Prices cost centre wise and one of the cost centre H is optional and is an incidental but integral part of the Supply contract

Cost Centres C to G would only make it a composite supply and the supply of intermediate cars being the principal supply, the entire supply done under cost Centres A to E would be deemed to be the supply of intermediate cars.

milestones are only artificial creations to enable cash flows to the applicant, this is treated as a naturally bundled supply with the supply of intermediate cars

the intention of the parties is to make it an integral part of the same supply contract and the contract is for “Supply of 150 Nos Standard Guage Intermediate Cars as per the requirements of BMRCL compatible with and suitable for integration with existing trains of Bangalore Metro Rail Project Phase 1”

Cost Centres C, D, E and G to be treated as forming a composite supply and the same is to be treated as supply of intermediate cars.

Read & download the copy in pdf:

CA Rachit Agarwal

CA Rachit Agarwal