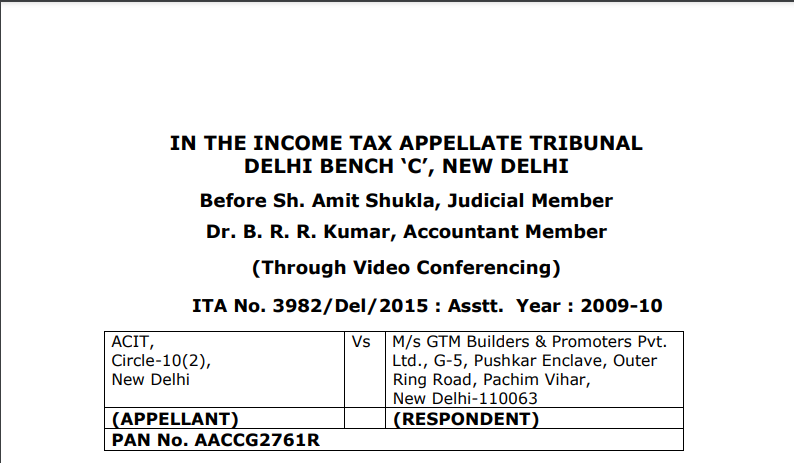

Delhi ITAT Order in the case of ACIT V/s. M/s GTM Builders & Promoters Pvt. Ltd.

Table of Contents

Case Covered:

ACIT

Versus

M/s GTM Builders & Promoters Pvt. Ltd.

Facts of the Case:

The present appeal has been filed by the revenue against the order of ld. CIT(A)-41 , New Delhi dated 25 .03.2015.

Following grounds have been raised by the revenue:

“1. Whether on the facts and circumstances of the case & in law, the ld. CIT (A) erred in deleting the addition of Rs.3,35,87,118/- made on account of bogus purchases.

2. Whether on the facts and circumstances of the case & in law, the ld. CIT (A) erred in ignoring the fact that even after providing sufficient opportunities the assessee failed to produce even a single party from whom purchases have been made.”

Observations:

Heard the arguments of both the parties and perused the material available on record.

We find that the AO has disallowed the purchases made from the four parties namely, M/s Meet Enterprises, M/s Suman Enterprises, M/s Durga Enterprises, and M/s Bharat Trading. Primarily, we find that the AO has relied on the information collected by the Investigation Wing, and no opportunity to cross-examine the parties has been afforded which is a violation of principles of natural justice. The assessee has provided copies of purchase bills, weightage bills, and architect certificates. The AO has not reasoned that the bills or the certificate of the architects are bogus and wrong on facts.

Order:

As per accounting standards AS-7, the purchases, and working progress have to be reconciled along with the architect report. The AO has not rejected the books of accounts and accepted the book profits while making the addition. The Assessing Officer’s observation that none of the architects can find out the actual material, steel bars used in the construction of any building of 2 to 3 years cannot be accepted as the consumption of the material can be well estimated from the drawings and the site books. In the case of M/s Suman Enterprises, the statement of Amit Vashisht indicates that the firm has been registered and run by Shri Deepak, no further inquiries have been conducted. In the case of M/s Meet Enterprises, the statement of Shri Sunil Kumar was recorded but nowhere it reveals or confirms that the purchases were bogus or inflated. There was no doubt about the payments made by the assessee to these parties and no evidence of cash withdrawals have been brought on record. The Assessing Officer contentions that non-production of parties can give credence to the bogus nature of the purchases cannot be accepted. In this regard, reliance is placed on the decision of the Hon’ble High Court of Bombay in the case of B.C. Borana Vs ITO 282 ITR 252. In the case of M/s Suman Enterprises, the Inspector report cannot be given credence as the party was found to be genuine on inquiry. The better way for the A could be to enquire about the amounts received from the assessee and from such amounts, if any, purchases of material have been made which in turn supplied to the assessee. The non-purchase of material/non-utilization of the amounts for purchase of material by the suppliers would be appropriate evidence to disallow these purchases but the same has been wanting. Reliance is placed on the judgment of Hon’ble jurisdictional High Court in the case of CIT Vs Rajesh Kumar 172 taxman 74 wherein it was held that failure to follow principles of natural justice vitiate the proceedings. Reliance is placed on the order of Hon’ble High Court of Bombay in the case of CIT Vs Nikunj Eximp Pvt. Ltd. 2013 TIOL 04 wherein it was held that no addition is warranted based on the fact that the suppliers have not appeared before the AO.

Hence, keeping in view the entire facts and circumstances of the case, evidence on record, we decline to interfere with the order of the ld. CIT (A) in deleting the addition.

As a result, the appeal of the revenue is dismissed. Order Pronounced in the Open Court on 08/02/2021.

Read & Download the Full Order in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.