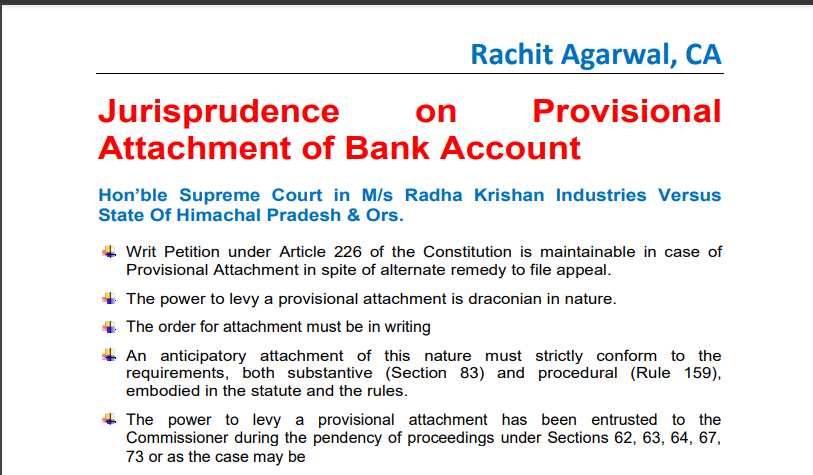

Jurisprudence on Provisional Attachment of Bank Account

Hon’ble Supreme Court in M/s Radha Krishan Industries Versus State Of Himachal Pradesh & Ors.

- Writ Petition under Article 226 of the Constitution is maintainable in case of Provisional Attachment in spite of alternate remedy to file an appeal.

- The power to levy a provisional attachment is draconian in nature.

- The order for attachment must be in writing

- An anticipatory attachment of this nature must strictly conform to the requirements, both substantive (Section 83) and procedural (Rule 159), embodied in the statute and the rules.

- The power to levy a provisional attachment has been entrusted to the Commissioner during the pendency of proceedings under Sections 62, 63, 64, 67, 73 or as the case may be

- Formation of opinion must be

– before ordering a provisional attachment

– based on “Tangible Material”

– must give conclusion government revenue cannot be protected without ordering a provisional attachment. There must be live nexus

- Merely the proceedings were completed and demand has been confirmed against another taxable entity would not satisfy the requirements of Provisional Attachment.

- Commissioner rejecting the objection filed by assessee must pass a reasoned speaking order

- Filing Objection against the Provisional Attachment and providing a reasonable opportunity of being heard before rejecting the objection is cumulative.

- The opportunity of being heard to be given before rejecting the Objection filed by the assessee against the Provisional Attachment Order.

- Appeal against the order of Provisional Attachment passed by Commissioner shall lie before Appellate Tribunal and not Appellate Authority as Commissioner is not Adjudicating Authority.

- Order of Provisional Attachment shall come to an end, once the order has been passed u/s 74(9) of HPGST Act, 2017

CA Rachit Agarwal

CA Rachit Agarwal