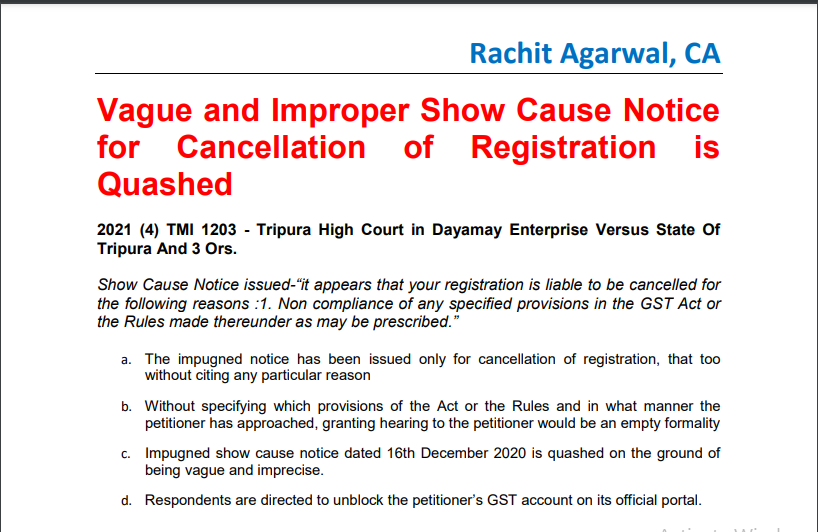

2021 (4) TMI 1203 – Tripura High Court in Dayamay Enterprise Versus State Of Tripura And 3 Ors.

Show Cause Notice issued-“it appears that your registration is liable to be cancelled for the following reasons :

1. Non-compliance of any specified provisions in the GST Act or the Rules made thereunder as may be prescribed.”

a. The impugned notice has been issued only for cancellation of registration, that too without citing any particular reason

b. Without specifying which provisions of the Act or the Rules and in what manner the petitioner has approached, granting a hearing to the petitioner would be an empty formality

c. Impugned show cause notice dated 16th December 2020 is quashed on the ground of being vague and imprecise.

d. Respondents are directed to unblock the petitioner’s GST account on its official portal.