Notification No. 15 /2021–Central Tax

Table of Contents

Notification No. 15 /2021–Central Tax

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF INDIRECT TAXES AND CUSTOMS)

NOTIFICATION

New Delhi, the 18th May 2021

No. 15 /2021–Central Tax

G.S.R. 333(E).—In exercise of the powers conferred by section 164 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on the recommendations of the Council, hereby makes the following rules further to amend the Central Goods and Services Tax Rules, 2017, namely: –

1. Short title and commencement. –

(1) These rules may be called the Central Goods and Services Tax (Fourth Amendment) Rules, 2021.

(2) They shall come into force on the date of their publication in the Official Gazette.

2. In the Central Goods and Services Tax Rules, 2017, –

(i) in rule 23, in sub-rule (1), after the words “date of the service of the order of cancellation of registration”, the words and figures “or within such time period as extended by the Additional Commissioner or the Joint Commissioner or the Commissioner, as the case may be, in the exercise of the powers provided under the proviso to sub-section (1) of section 30,” shall be inserted;

(ii) in rule 90, –

(a) in sub-rule (3), the following proviso shall be inserted, –

“Provided that the time period, from the date of filing of the refund claim in FORM GST RFD-01 till the date of communication of the deficiencies in FORM GST RFD-03 by the proper officer, shall be excluded from the period of two years as specified under sub-section (1) of Section 54, in respect of any such fresh refund claim filed by the applicant after rectification of the deficiencies.”;

(b) after sub-rule (4), the following sub-rules shall be inserted, namely: –

“(5) The applicant may, at any time before issuance of provisional refund sanction order in FORM GST RFD-04 or final refund sanction order in FORM GST RFD-06 or payment order in FORM GST RFD-05 or refund withhold order in FORM GST RFD-07 or notice in FORM GST RFD-08, in respect of any refund application filed in FORM GST RFD-01, withdraw the said application for refund by filing an application in FORM GST RFD-01W.

(6) On submission of application for withdrawal of refund in FORM GST RFD-01W, any amount debited by the applicant from electronic credit ledger or electronic cash ledger, as the case may be, while filing an application for refund in FORM GST RFD-01, shall be credited back to the ledger from which such debit was made.”;

(iii) in rule 92, –

(a) in sub-rule (1), the proviso shall be omitted;

(b) in sub-rule (2), –

(i) for the word and letter “Part B”, the word and letter “Part A” shall be substituted;

(ii) the following proviso shall be inserted, namely: –

“Provided that where the proper officer or the Commissioner is satisfied that the refund is no longer liable to be withheld, he may pass an order for the release of withheld refund in Part B of FORM GST RFD- 07.”;

(iv) in rule 96, –

(a) in sub-rule (6), for the word and letter “Part B”, the word and letter “Part A” shall be substituted;

(b) in sub-rule (7), for the words, letters, and figures, “after passing an order in FORM GST RFD-06”, the words, letters and figures, “bypassing an order in FORM GST RFD-06 after passing an order for the release of withheld refund in Part B of FORM GST RFD-07” shall be substituted;

(v) in FORM GST REG-21, under the sub-heading “Instructions for submission of application for revocation of cancellation of registration”, in the first bullet point “after the words “date of service of the order of cancellation of registration”, the words and figures “or within such time period as extended by the Additional Commissioner or the Joint Commissioner or Commissioner, as the case may be, in the exercise of the powers provided under the proviso to sub-section (1) of section 30,” shall be inserted;

(vi) in rule 138E, for the words “in respect of a registered person, whether as a supplier or a recipient, who, —” the words „‟in respect of any outward movement of goods of a registered person, who, —” shall be substituted.

Related Topic:

Notification No. 88/2020 – Central Tax

(vii) for FORM GST RFD-07, the following FORM shall be substituted, namely: –

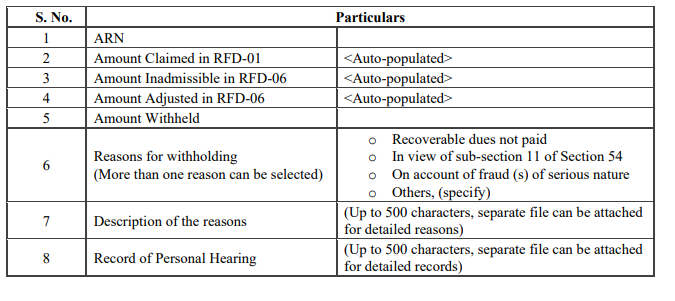

“FORM GST RFD-07

[See rules 92(2) & 96(6)]

Reference No.

Date: <DD/MM/YYYY>

To

___________ (GSTIN/UIN/Temp. ID)

___________ (Name)

____________ (Address)

———————— (ARN)

Part-A

Order for withholding the refund

Refund payable to the taxpayer with respect to ARN specified above are hereby withheld in accordance with the provisions of sub-section (10)/(11) of section 54 of the CGST Act, 2017. The reasons for withholding is given as under:

Part-B

Order for release of withheld refund

This has reference to your refund application dated against which the payment of refund amount sanctioned vide order dated was withheld by this office order dated. It has been now found to my satisfaction that the conditions for withholding of refund no longer exist and therefore, the refund amount withheld is hereby allowed to be released as given under:

Date:

Signature (DSC):

Place:

Name:

Designation:

Office Address: ”;

(viii) after FORM GST RFD-01 B, the following FORM shall be inserted, namely: –

“FORM GST RFD-01 W

[Refer Rule 90(5)]

Application for Withdrawal of Refund Application

1. ARN:

2. GSTIN:

3. Name of Business (Legal):

4. Trade Name, if any:

5. Tax Period:

6. Amount of Refund Claimed:

7. Grounds for Withdrawing Refund Claim:

i. Filed the refund application by mistake

ii. Filed Refund Application under the wrong category

iii. Wrong details mentioned in the refund application

iv. Others (Please Specify)

8. Declaration: I/We hereby solemnly affirm and declare that the information given herein is true and correct to the best of my/ our knowledge and belief and nothing has been concealed therefrom.

Place:

Signature of Authorised Signatory

Date:

Name

Designation/ Status”.

[F. No. CBEC-20/06/04/2020-GST]

RAJEEV RANJAN, Under Secy.

Note:

The principal rules were published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i), vide notification No. 3/2017-Central Tax, dated the 19th June 2017, published vide number G.S.R. 610 (E), dated the 19th June 2017 and was last amended vide notification No. 13/2021-Central Tax, dated the 01.05.2021, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 309(E), dated the 01st May 2021.

Related Topic:

Notification No. 18/2018-Central Tax (Rate)

Read & Download the Notification in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.