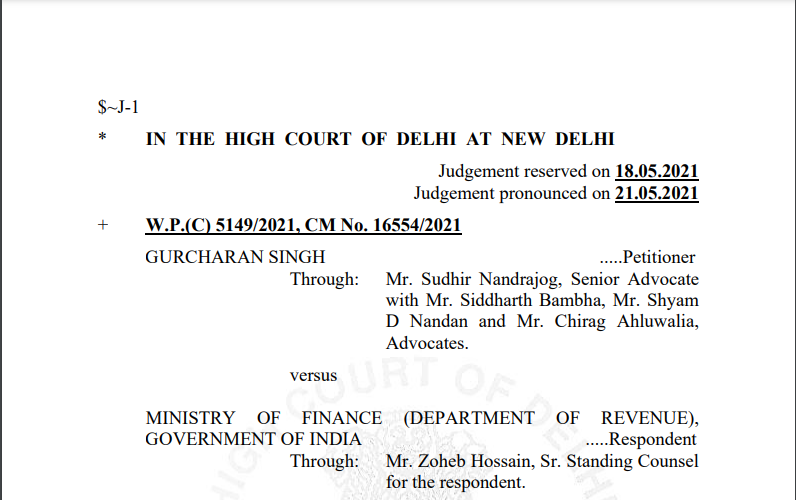

Delhi HC Order in the case of Gurcharan Singh Versus Ministry Of Finance

Table of Contents

Case Covered:

Gurcharan Singh

Versus

Ministry Of Finance

Facts of the Case:

This is a George Floyd moment for the citizens of this country. The refrain is “I can’t breathe”, albeit, in a somewhat different context and setting; although in circumstances, some would say, vastly more horrifying and ghastlier. Chased and riven by the merciless novel Coronavirus, the citizenry has been driven to desperation and despair.

Scarcity of liquid medical oxygen [in short “LMO”], medicines, oxygen concentrators, hospital beds, ventilators, and other medical equipment, crucial for battling against the infection caused by the virus, has brought out the best and worst in people. We have messiahs. We have charlatans. We have hoarders. We have seen kind and caring hands being struck out by strangers when they could have remained cocooned in the safety of their houses. Brave hearts, there are many; doctors, nurses, and personnel manning public institutions. These are people who are at the forefront of this battle, staking their lives, so that the common man could live; beating this adversary, i.e., the virus is their only goal. There is, thus, in this litigation, no adversary other than the virus.

The petitioner is 85 years old. He has approached this Court against the imposition of IGST on the import of the oxygen concentrator which has been gifted to him by his nephew. The petitioner, as alluded to above, asserts that the imposition of tax is discriminatory, unfair, and unreasonable and that it impinges upon his right to life and health. The clearance of the oxygen concentrator from the customs barrier required payment of IGST at the rate of 12%. It is relevant to note that before 01.05.2021, an individual importer would have had to pay IGST at the rate of 28% qua oxygen concentrator gifted to him for personal use. This stood in contrast to oxygen concentrators which were imported for commercial use. The IGST on the oxygen concentrator, which was imported for commercial use, was and continues to be leviable at the rate of 12%.

The State claims that to remove this dissonance, it issued the impugned notification dated 01.05.2021, whereby, IGST on oxygen concentrators imported by individuals for personal use, that are supplied free of cost, was scaled down to 12%. The State avers that it went a step further by issuing yet another notification, i.e., notification no. 4/2021-Customs, dated 03.05.2021, whereby, it exempted, completely, oxygen concentrators imported for the purpose of COVID relief from the imposition of IGST in cases, where the importer was the “State Government or, any entity, relief agency or statutory body, authorized in this regard by any State Government” [hereafter collectively referred to as the “canalizing agency’]. The exemption, though, is available only till 30.06.2021. It is for this reason that we had observed on 05.05.2021 that, since the State has come so far, it could go a little further and exempt even individual importers who had been supplied oxygen concentrators free of cost from bearing the burden of IGST.

However, our attempt at nudging the State to take, what we thought was a reasonable stand, [and we dare say, a morally right position] has come a cropper.

Observations of the Hon’ble Court:

Having found so, in our view, a declaratory relief can be accorded, to the effect, that imposition of IGST on oxygen concentrators, imported as gifts, i.e., free of cost, for personal use, is violative of Article 14 of the Constitution on the ground that an artificial, unfair and unreasonable distinction has been drawn between persons, who are similarly circumstanced as the petitioner and those who import oxygen concentrators through a canalizing agency.

The logical sequitur of this would be that persons who are similarly circumstanced as the petitioner, i.e., those who obtain imported oxygen concentrators as gifts, for personal use, cannot also be equated with those who import oxygen concentrators for commercial use. Therefore, notification bearing no. 30/2021-Customs, dated 01.05.2021, will also have to be quashed.

The Decision of the Court:

Accordingly, we hold that imposition of IGST on oxygen concentrators that are imported by individuals and are received by them as gifts [i.e. free of cost] for personal use, is unconstitutional.

Given the declaration made hereinabove, notification no. 30/2021 dated 01.05.2021 is quashed.

To obviate misuse of the oxygen concentrators, by the petitioner and/or persons similarly circumstanced, she/he/they would have to furnish a letter of undertaking to the officer designated by the State that the same would not be put to commercial use. The petitioner would thus submit a letter of undertaking with seven days of the State intimating/notifying the particulars of the officer designated for this purpose. Till such time an officer is designated by the State, the direction set forth in paragraph 17.7 above will operate.

The writ petition is disposed of in the aforesaid terms. The pending application shall also stand closed.

The Registry is directed to release the money, deposited with it, by the petitioner, along with interest, if any accrued, at the earliest.

Before we part with the judgement, we must place on record our appreciation for the invaluable assistance rendered by Mr. Arvind Datar, Mr. Zoheb Hossain, Mr. Sudhir Nandrajog as also Mr. Siddharth Bambha. Their assistance helped us to traverse over what was, somewhat, new and uneven terrain.

Read & Download the Full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.