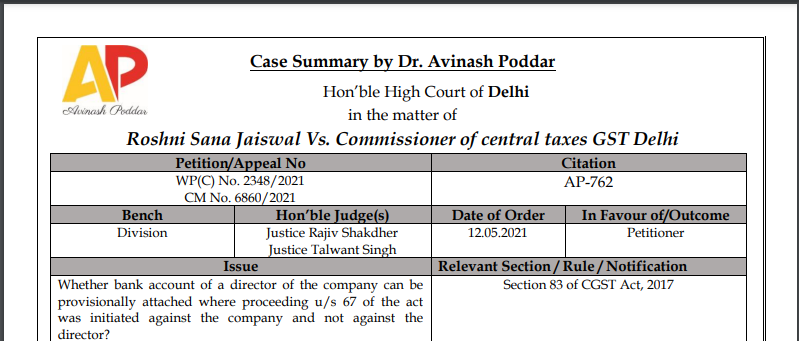

Delhi HC in the case of Roshni Sana Jaiswal Vs. Commissioner of central taxes GST Delhi

Table of Contents

Case Covered:

Roshni Sana Jaiswal

Vs.

Commissioner of central taxes GST Delhi

Issue:

Whether bank account of a director of the company can be provisionally attached where proceeding u/s 67 of the act was initiated against the company and not against the director?

Brief Facts of the Case:

- The Petitioner was acting as a director of M/s Milk Food Ltd between 2006 and 2008. Since then she has been working in a company in the capacity of a mentor/advisor. She drew a salary of Rs. 1.50 Cr. for the F.Y. 2019-20. The Petitioner is also a shareholder in the company and holding approx. 14.33% equity shares of the company.

- Proceeding u/s 67 of the act was initiated against M/s Milk Food Ltd on the ground of availing ITC against bogus/fake invoices.

- Statement of the petitioner was recorded on 03.12.2020

- This writ petition is directed against the orders of even date, i.e., 07.12.2020 passed by the respondent, whereby several bank accounts of the petitioner have been provisionally attached.

- 4 different bank account of the petitioner was provisionally attached u/s 83 of the Act.

- Aggrieved by such provisional attachment, the petitioner filed this petition.

- Objection against the said provisional attachment as per rule 159(5) of the CGST Rules was filed.

- The abovementioned objections were disposed of by the respondents on 19.04.2021.

Brief Arguments by Petitioner/ Appellant:

Mr Harsh Sethi, who appears on behalf of the petitioner, submitted that. the proceeding initiated against the petitioner. under Section 83 of the Act. is without jurisdiction, as the petitioner does not fall within the ambit of the definition of a ‘taxable person’; the taxable person being Milkfood Ltd and not the petitioner. Therefore, the impugned orders cannot be sustained, as this crucial jurisdictional ingredient is missing. Mr Sethi says that the other ingredients, provided in Section 83 of the Act, are also missing. The respondent, before triggering the provisions of Section 83 of the Act, had to satisfy itself that there was a “pending” proceeding under the provisions of Section 62 or Section 63 or Section 64 or Section 67 or Section 73 or Section 74 of the Act. Furthermore, Mr Sethi says that the respondent was also required to form an opinion, before taking recourse to Section 83 of the Act, that attachment of the petitioner’s bank account was necessary for the purpose of protecting the interest of the revenue.

Mr Sethi says that the principles enunciated in Radha Krishan Industries Case, squarely apply to the instant case. In this context, Mr Sethi relies, in particular, on paragraphs 41 and 72(iv) & (v) of the judgement rendered in the Radha Krishan Industries Case.

Brief Arguments by Respondents:

The petitioner has availed of the alternate remedy available to it under Rule 159(5) of the Central Goods and Services Tax Rules, 2017, by filing objections under the said Rule, albeit during the pendency of the writ petition. Mr Singh says that since objections, were filed during the pendency of the writ petition and after the counter-affidavit was filed on behalf respondent, there is no reference to this aspect of the matter, in the counter-affidavit. Mr Singh states that the objections were disposed of vide order dated 19.04.2021.

Milkfood Limited has availed ITC credit. to the extent of approximately Rs.85 crores, based on fake invoices. The respondent had arrested persons, who controlled the entities which furnished fake invoices to Milkfood Ltd. Coercive proceedings were also intended to be triggered against the directors/employees of Milkfood Ltd. The persons, connected to the suppliers and the directors/employees of Milkfood Ltd., had approached the concerned courts for grant of bail. In those proceedings, Rs.10 crores were deposited with the respondent, as the condition of bail. In addition, thereto, Rs.6 crores were voluntarily deposited by Milkfood Ltd. with the respondent. In all, out of an approximate amount of Rs.85 crores, Rs.16 crores stands deposited with the respondent.

Cases relied upon by:

Petitioner

- M/s Radha Krishan Industries vs. State of Himachal Pradesh & Ors. = 2021-TIOL-179-SC-GST

Respondent

–

Judgement/ Ratio (in brief):

The submission advanced by Mr Singh, that the instant petition. under Article 226 of the Constitution, should not be entertained as recourse to an alternate remedy was taken by the petitioner, does not impress us, since the exercise of power under Section 83 of the Act, to begin with, was without jurisdiction. In this case, one of the jurisdictional ingredients’, which is missing, is that the petitioner is not a taxable person. This aspect is borne out upon perusal of the impugned orders, which are identical. In the impugned orders, dated 07.12.2020, the respondent adverts to the fact that Milkfood Ltd. is the taxable person.

As indicated above, we are told that the order rejecting the petitioner’s objections under Rule 159(5) was passed on 19.04.2021. This order has not been placed on record. We are also not told of the date on which the objections were filed. On being queried, Mr Singh concedes that the order, passed under the aforestated Rule, on 19.04.2021, is not appealable. We must, however, indicate that this aspect apart, the respondent has not been able to place before us, any material, which would show that. the concerned officer, before triggering the provisions of Section 83 of the Act, had applied his mind to the other important aspect, which is, that the provision had to be taken recourse to, to protect the interest of the revenue.

Accordingly, for the foregoing reasons, we are inclined to allow the writ petition. It is ordered accordingly. The impugned provisional attachment orders dated 07.12.2020. are quashed. The respondent will communicate the order passed today to the concerned Banks.

Consequently, the order dated 19.04.2021, disposing of the objections filed by the petitioner, would also collapse, in its entirety, as the proceedings carried out against the petitioner were without jurisdiction.

All concerned shall act on a digitally signed copy of the judgement passed today. The pending application shall stand closed.

Head Note/ Judgement in Brief:

Can the bank account/accounts of a director of the company can be provisionally attached where proceeding u/s 67 of the act was initiated against the company and not against the director. NO

Authors View:

Section 83 provides for the empowerment of the Commissioner to provisionally attach the property including the bank account of the taxable person. It clearly means that the property or bank account of any person other than the taxable person against whom the proceedings under section 62 or 63 or 64 or 67 or 73 or 74, is not pending cannot be attached and therefore the Hon’ble Court was pleased to held that the order of attachment is without jurisdiction.

Dr. Avinash Poddar

Dr. Avinash Poddar

Ahemdabad, India

Avinash Poddar, currently practicing as a lawyer, as a Law Graduate, a fellow member of Institute of Chartered Accountants of India, Certified Financial Planner, Microsoft Certified Professional and DISA (Diploma in Information Systems Audit) from ICAI. He has also completed various certificate courses of ICAI such as Arbitration, Forensic Accounting and Fraud Detection, Valuation, IFRS, Indirect Taxes. He has also completed post-graduate diploma is Cyber Crime (PGCCL).