Notification No. 20/2021 – Central Tax

Notification No. 20/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central Board of Indirect Taxes and Customs

Notification No. 20/2021 – Central Tax

New Delhi, the 1st June 2021

G.S.R…..(E).— In exercise of the powers conferred by section 128 of the Central Goods and Services Tax Act, 2017 (12 of 2017) (hereafter in this notification referred to as the said Act), the Government, on the recommendations of the Council, hereby makes the following further amendments in the notification of the Government of India in the Ministry of Finance (Department of Revenue), No. 4/2018– Central Tax, dated the 23rd January 2018, published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i) vide number G.S.R. 53(E), dated the 23rd January 2018, namely: — In the said notification, after the fourth proviso, the following proviso shall be inserted, namely: —

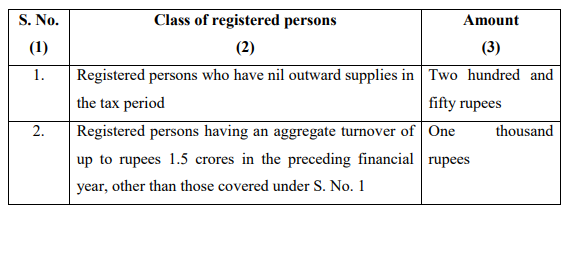

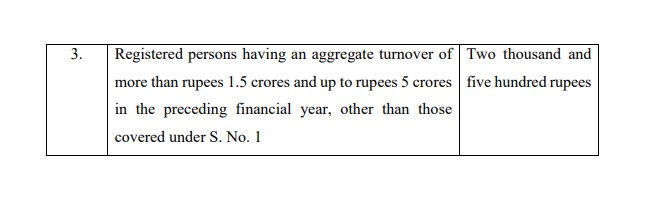

“Provided also that the total amount of late fee payable under section 47 of the said Act for the tax period June 2021 onwards or quarter ending June 2021 onward, as the case may be, shall stand waived which is in excess of an amount as specified in column (3) of the Table given below, for the class of registered persons mentioned in the corresponding entry in column (2) of the said Table, who fail to furnish the details of outward supplies in FORM GSTR-1 by the due date, namely: —

Table

[F. No. CBIC-20001/5/2021]

(Rajeev Ranjan)

Under Secretary to the Government of India

Note: The principal notification No. 4/2018-Central Tax, dated 23rd January 2018 was published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 53(E), dated the 23rd January 2018, and was last amended vide notification number 53/2020 – Central Tax, dated the 24th June 2020, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 406(E), dated the 24th June 2020.

Related Topic:

Online filing of AEO T2 and AEO T3 applications: CBIC

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.