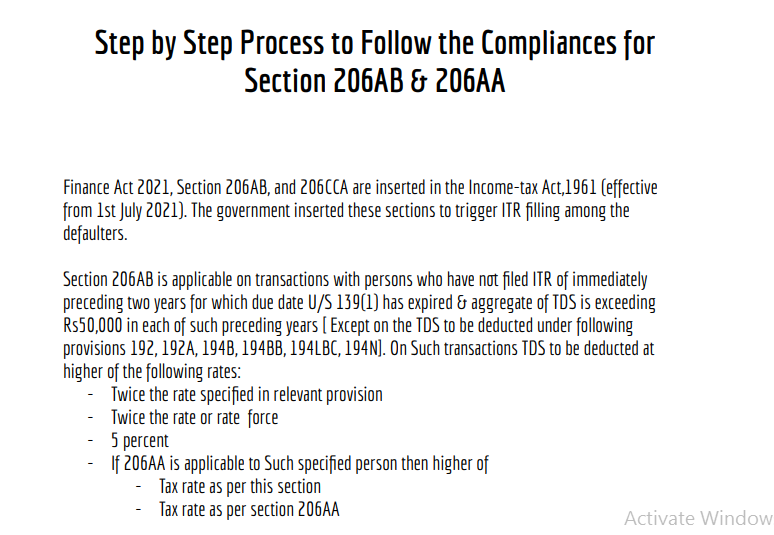

Step by Step Process to Follow the Compliances for Section 206AB & 206AA

Finance Act 2021, Section 206AB, and 206CCA are inserted in the Income-tax Act,1961 (effective from 1st July 2021). The government inserted these sections to trigger ITR filling among the defaulters.

Section 206AB is applicable on transactions with persons who have not filed ITR immediately preceding two years for which due date U/S 139(1) has expired & aggregate of TDS is exceeding Rs 50,000 in each of such preceding years [Except on the TDS to be deducted under following provisions 192, 192A, 194B, 194BB, 194LBC, 194N]. OnSuchtransactions TDS to be deducted at higher of the following rates:

– Twice the rate specified in the relevant provision.

– Twice the rate or rate force.

– 5 percent.

– If 206AA is applicable toSuchspecifiedpersonthenhigher of.

– Tax rate as per this section.

– Tax rate as per section 206AA.

Related Topic:

A Handy Checklist of Various Compliances to Be Completed Till 31 July 2021

Section 206CCA is applicable on transactions with persons who have not filed ITR immediately preceding two years for which due date U/S 139(1) has expired & aggregate of TCS is exceeding Rs 50,000 in each of such preceding years [Except Non-Resident person who does not have a permanent establishment inIndia]. On Such transactions TCS to is Collected at higher of the following rates:

– Twice the rate specified in the relevant provision

– Twice the rate or rate force

– 5 percent

– If 206CC is applicable to such specified person the higher of

– Tax rate as per this section

– Tax rate as per section 206CC

Related Topic:

305th issue of Tax Connect

Complications in Applicability of these Sections & the New Functionality by Income tax department to overcome these Complications.

There was no system, process, or procedure to determine the applicability of these sections, it was very hard to verify that the person from whom TDS is to be deducted or TCSis to be Collected falls under the criteria of these sections or not.

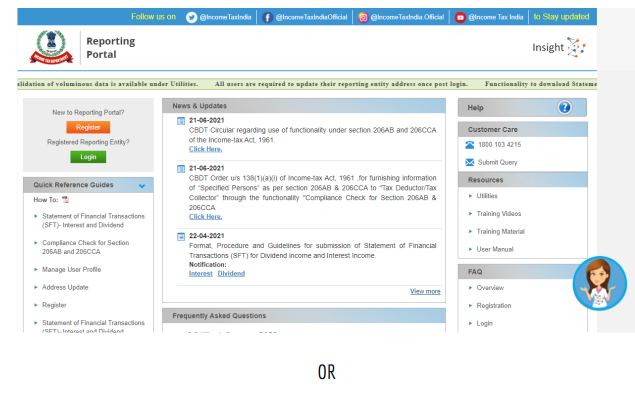

To Help the tax Deductors/collectors of TDS/TCS to follow the Compliances of these sections, the Income Tax Department has launched a new Functionality “Compliance Check for Section 206AB & 206CCA” this new functionality enables the tax deductors/collectors to Verify the specified person defined under these sections.

Step by step Guide to Register “Compliance Check for Section 206AB & 206CCA” To access the New Functionality Tax deductors/Collectors will have to Register through the reporting portal of the Income Tax Department. Go through the following steps for registration of TAN on the reporting portal.

Step: 1 Visit reportingportal at URL https://reportdotinsightdotgovdotin

Step: 2 Click on Register, on the left side of the homepage

Step: 3 you will be redirected to- filing login page

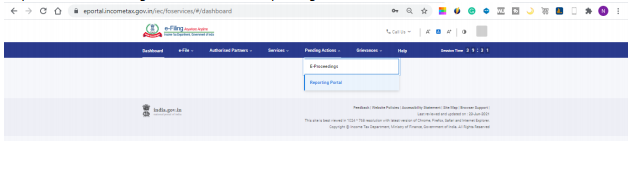

Step: 3 Directlygo to the e-filing portal through http://wwwdotincometaxdotgovdotin/

Step: 4 Login to e-filing using the e-filing-login credential of TAN.

Step: 5 Under “Pending Actions”, select “Reporting Portal”

Step: 6 After being redirected to the Reportingportal, select New Registrationoptionand to click Continue.

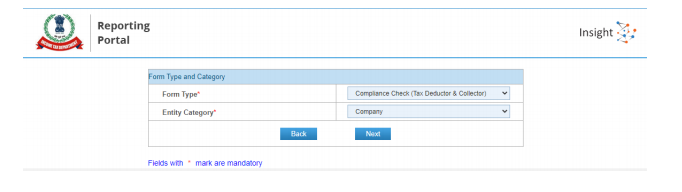

Step: 7. Now select the Form type as Compliance Check (Tax Deductor & Collector). the entity Category & Entity Category will be auto-filled on the basis on which is registered on E filing.

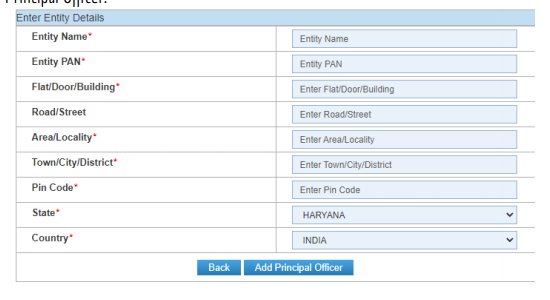

Step: 8 Enter relevant entity details on the entity details page and click on the “Add Principal Officer” button to add Principal Officer.

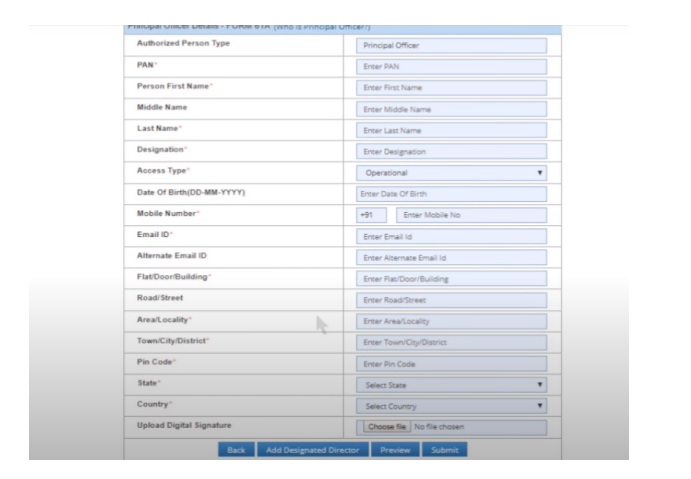

Step: 9 Enter Principal Officer details on the Principal Officer Details page.

Step: 10 Details of Nodal officer, Alternate Officer, Alternate Nodal Officer & other users if required to be registered. Then the details of such users can be continued or can be added later after registration.

Step: 11 Click on the Preview button to view the entered entity and principal officer details.

Step: 12 Click on the submit button to submit the registration request.

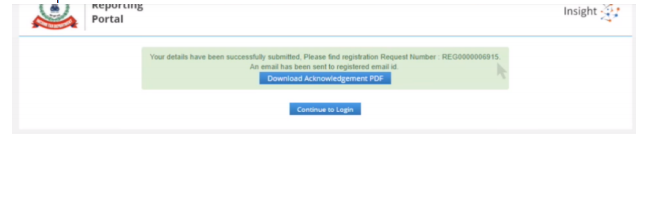

Step: 13 On the next screen you will see Acknowledgement receipt of registration request & it will also be provided on E-mail.

Step: 14 Once the registration request is approved by the Income-tax Department, an email notification will be shared with the Principal Officer along with ITDREIN details and login credentials.

Step by step guide to access the new functionality – by Principal officer

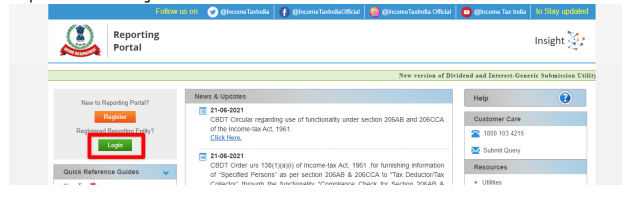

Step: 1 Visit reporting portal at URLhttps://reportdotinsightdotgovdotin.

Step: 2 click the Login button.

Step: 3 Enter the required details (of Principal Officer) and click Login to continue.

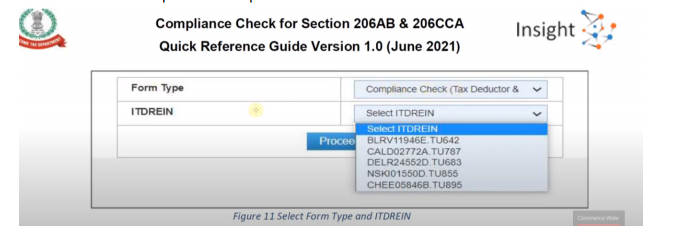

Step: 4 If the Principal Officer’s PAN is registered for multiple Forms & ITDREIN, he/she needs to select the Form type as Compliance Check (Tax Deductor & Collector) and associated ITDREINs from the drop-down.

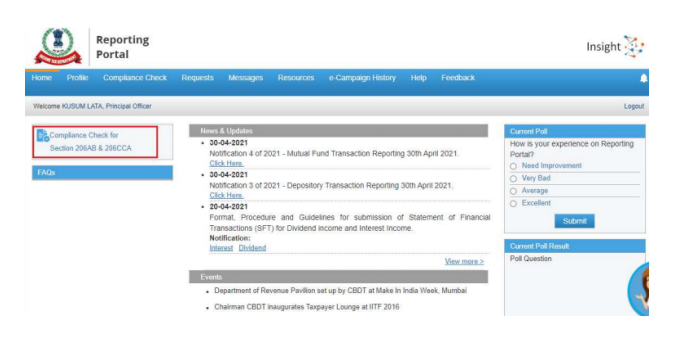

Step: 5 After successfully logging in, the home page of Reporting Portal appears.

Step: 6 Click on Compliance Check for section 206 AB & 206CCA link provided as a shortcut on the left panel.

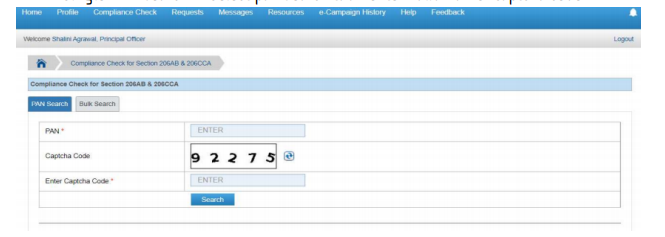

Step: 7 Compliance check

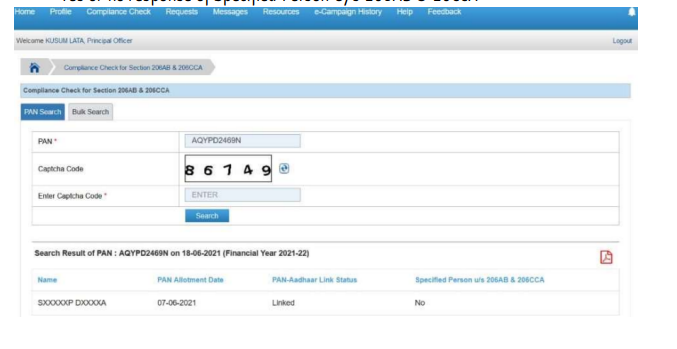

● Single PAN search -Selectpansearchtab > enter valid Pan & Captcha code

On entering Valid details following Result will be displayed:

– Current Financial year

– PAN of the Person

– Name of the person

– Panallotment date

– Pan-aadhar link status

– Yes or no response of specified Person U/s 206AB & 20CCA

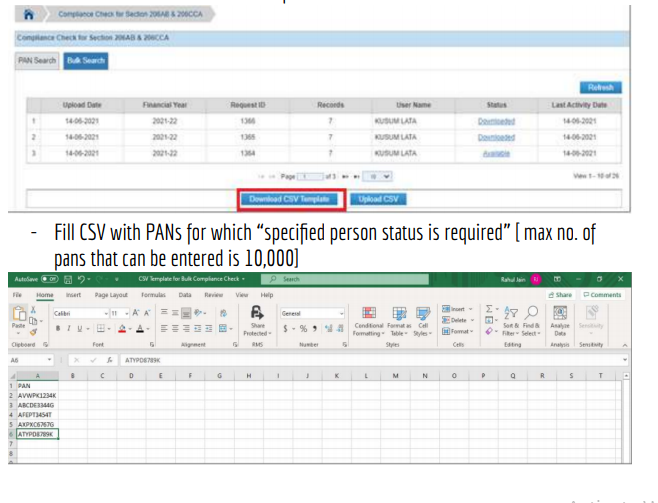

● Bulk Search- Download CSV template to enter PAN details in bulk

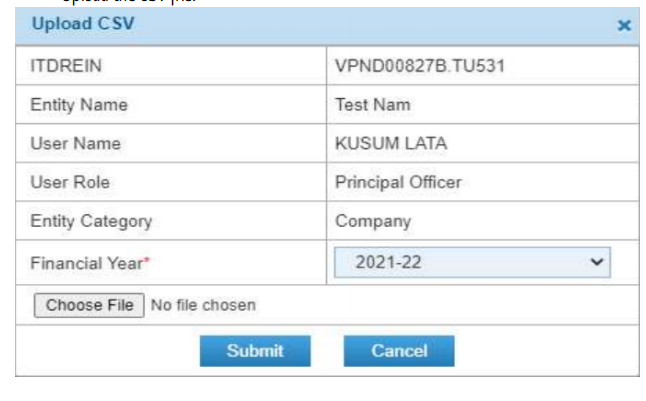

– Upload the CSV file.

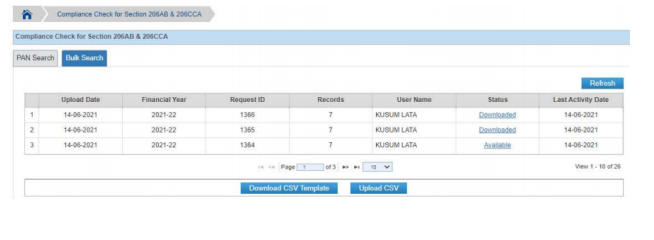

– Uploaded file will start reflecting with the Uploaded status. The status will be as follows:

– Uploaded–The CSV has been uploaded and pending processing.

– Available– Uploaded CSV has been processed and results are ready for download.

– Downloaded–Theuserhas downloaded the output results CSV.

– Link Expired– Download link has expired.

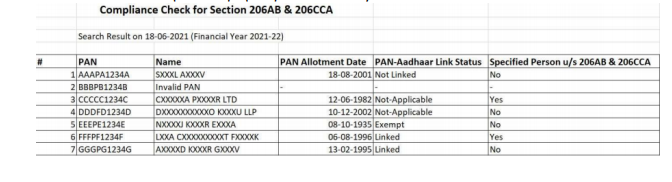

– Output CSV file will have FY, PAN, Name of the PAN holder (masked), PAN Allotment Date, PAN-Aadhaar link status and specified Personu/s 206AB & 206CCA status.

– On entering Valid details following Result will be displayed:

– Current Financial year

– PAN of the Person

– Name of the person

– Pan allotment date

– Pan-aadhar link status

– Yes or no response of specified Person U/s 206AB & 20CCA

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.