Central & State Subsidies for Textile Industry

Table of Contents

Importance of Textile Industry

• GDP – The textile sector plays an important role in the national economy owing to its major contribution to the GDP, industrial production, employment generation, and export revenue generation. The textile industry contributes 14% of India’s industrial production and 4% of its GDP.

Importance of Textile Industry

• EMPLOYMENT – The textile industry is one of the leading employment-generating industries in the country, employing approximately 5 crore people. The Indian textile industry has the second-largest industrial capacity in the world.

• EXPORTS – TEXTILE INDUSTRY accounts for 13% of total exports. The market for readymade garments is divided into three segments viz. domestic market, industrial market, and international market. Out of the total readymade garments production, 60% is consumed in the domestic sector, 21% is consumed in the industrial sector while 19% is exported.

Why subsidies to Textile?

• FOR VALUE ADDITION – INDIA IS A MAJOR EXPORTER OF RAW COTTON AND RAW MATERIAL FROM INDIA

• CONCEPT OF “FIBER TO FASHION”, IS INTRODUCED, MAKE IN INDIA

• STRATEGIC STRENGTH OF INDIA – Availability of raw material, skilled manpower, and lower production costs are its key strengths India has efficient rail, road, port, and airport infrastructure for connectivity, availability of electricity, skilled manpower, and abundantly available cotton

Sources of Subsidies

A TEXTILE INDUSTRY IN MAHARASHTRA GET SUBSIDIES FROM 3 DEPARTMENTS

1. Central Textile Department

2. State Textile Department

3. State District Industries Center – DIC

Central Subsidy – ATUFS

• ATUFS – AMENDED TECHNOLOGY UPGRADATION FUND SCHEME

• SUBSIDY DETAILS – WHAT SUBSIDY and PERIOD OF SCHEME

1) ATUFS DURATION – 13TH Jan 2016 to 31st March 2022 (Expected that the period will be increased in view of a pandemic)

2)NEW AS WELL AS EXPANSION UNIT DURING SUCH PERIOD

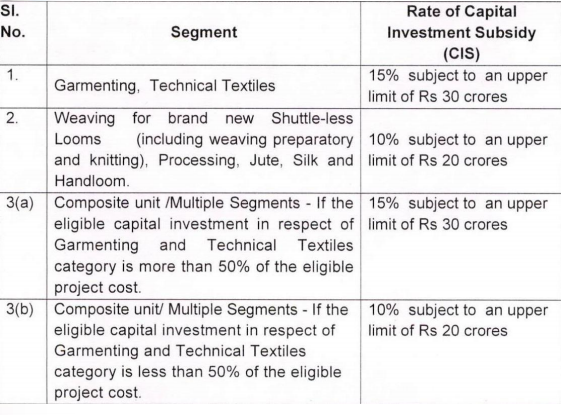

3) CIS – CREDIT LINKED SUBSIDY

Which Units Are Eligible –

1) Weaving and Knitting

2) Processing of Fibers, Yarns, Fabric

3) Technical Textiles

4) Garments and made up units

5) Handloom Sector

6) Silk Sector

7) Jute Sector

What Are Important Considerations –

1) Specification for Technology for the machines would be prescribed annually

2) Machinery – Directly from Machine Manufacturer or Agent

3) TAMC – Shall specify the indicative list of manufacturers

4) Machinery with lower technology won’t be applicable

5) List only Suggestive – Regularly updated and can also

6) Second Hand Machinery not eligible

7) Accessories – up to 20 % of the Cost of Machinery is eligible

8) Machinery shall not be disposed of before 10 years

What Is UID And When To Apply

1) UNIQUE IDENTIFICATION NUMBER ( UID ) – means provisional approval for an estimated capital subsidy based on a tentative estimate of specified machinery

2) Application has to done within 6 months from the Date of Sanction of Loan.

3) Scheme Is Credit Linked – Only Units Having Term Loan Of Min 50% Of Eligible Machine Cost. Min Repayment period of 3 years for MSME

4) Full Subsidy will be released in one Go

5) Machinery Purchased after Sanction of Term Loan only eligible

Read & Download the full Copy in pdf:

CA Kunal Budhraja

CA Kunal Budhraja

CA Kunal Budhraja has done his articles from Deloitte Haskins & Sells, Chartered Accountants, Pune, and has completed his CA in 2009. He has worked with Kotak Mahindra Bank Mumbai in the Internal Audit Team before being associated with Budhraja & Co. He is also a renowned speaker in the Nagpur region on topics ranging from GST, Financing, and Subsidy on various platforms including ICAI & Trade Bodies. Currently heading the Indirect Tax, Financing, and Internal Audit of the firm, he also looks after the day-to-day affairs of the firm. He has also completed Diploma of Information Systems Auditor (DISA)