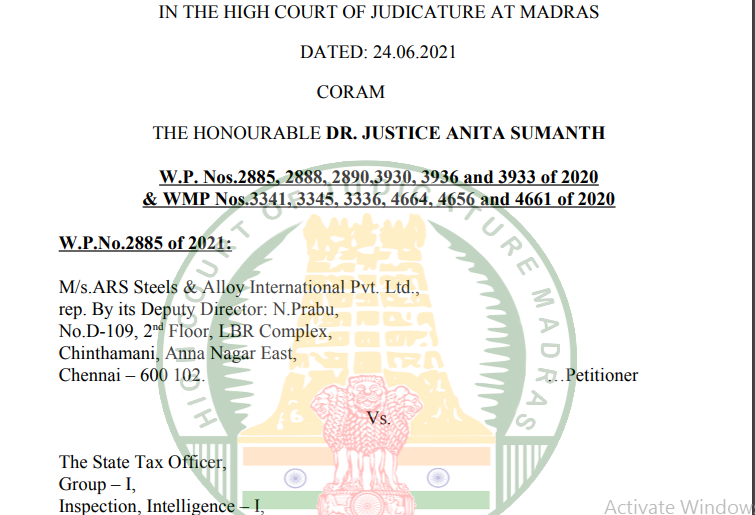

Madras HC in the case of M/s. ARS Steels & Alloy International Pvt. Ltd

Table of Contents

Case covered:

M/s. ARS Steels & Alloy International Pvt. Ltd

Versus

The State Tax Officer

Common Order:

This batch of Writ Petitions relates to two sets of assessment orders passed in the case of two assessees under the provisions of Goods and Services Tax Act, 2017 (in short ‘GST Act’) for the periods 2017-18, 2018-19, and 2019-20. They are disposed of by way of this common order since the legal issue that arises in these cases is one and the same.

2. In W.P.No.3936 of 2020, it is argued by Mr.Joseph Prabakar, learned counsel for the petitioner that an additional issue is raised in regard to stock reconciliation. The admitted position as far as this issue is concerned is that the vehicle movement register correlating to the vehicle gate passes issued, have been specifically sought for by the authorities but not produced at the time of assessment. Though the learned counsel for the petitioner states that the details have produced before this Court, learned counsel for the respondent would point out that this issue is factual in nature and as such, it would be better than the petitioner approached the appellate authority by way of a statutory appeal.

3. I agree, Since the evidence in support of the petitioner’s stand has been produced only at this stage, it would be appropriate that this issue should be dealt with by the departmental authorities in the first instance. The petitioner is permitted to file a statutory appeal as regards this issue within a period of four weeks (4) from today.

Related Topic:

Madras HC in the case of BGR Energy Systems Limited

4. As far as W.P.Nos.2885, 2888, and 2890 of 2020 are concerned, Mr.Mudimannan, learned counsel for the petitioner submits that apart from the legal issue raised in these Writ Petitions, statutory appeals have been filed with regard to the other issues.

5. This order is thus confined to a decision on the legal issue as to whether a reversal of Input Tax Credit (ITC) is contemplated in relation to loss arising from the manufacturing process.

Related Topic:

Epiphany by the Madras High Court in TRAN-1 debate

6. The petitioners are engaged in the manufacture of MS Billets and Ingots. MS scrap is an input in the manufacture of MS Billets and the latter, in turn, constitutes an input for the manufacture of TMT/CTD Bars. There is a loss of a small portion of the inputs, inherent to the manufacturing process. The impugned orders seek to reverse a portion of the ITC claimed by the petitioners, proportionate to the loss of the input, referring to the provisions of Section 17(5)(h) of the GST Act.

7. As regards the Legislative history of this provision, the erstwhile Tamil Nadu Value Added Tax Act, 2006 (in short ‘TNVAT Act’) contained an equivalent provision in Section 19 thereof, which deals with various situations arising from the grant and reversal of ITC. Section 19 (1) grants eligibility to ITC of the amount of tax paid under the TNVAT Act by a registered dealer. It sets out situations where such ITC shall be denied as well.

Related Topic:

Madras HC in the case of M/s. Sun Dye Chem Versus The Assistant Commissioner

8. The provisions of Section 19, as relevant for the issue dealt with in these matters, are extracted below:

19. Input tax credit .-

(1) There shall be an input tax credit of the amount of tax paid Omitted[or Payable] under this Act, by the registered dealer to the seller on his purchases of taxable goods specified in the First Schedule :

Provided that the registered dealer, who claims input tax credit, shall establish that the tax due On purchase of goods has actually been paid in the manner prescribed by the registered dealer who sold such goods and that the goods have actually been delivered Provided further that the tax-deferred under section 32 shall be deemed to have been paid under this Act for the purpose of this sub-section.

(8) No input tax credit shall be allowed to any registered dealer in respect of any goods purchased by him for sale but given away by him by way of free sample or gift or goods consumed for personal use.

(9) No input tax credit shall be available to a registered dealer for tax paid Omitted[or Payable] at the time of purchase of goods, if such-

(i) goods are not sold because of any theft, loss, or destruction, for any reason, including natural calamity. If a dealer has already availed input tax credit against the purchase of such goods, there shall be a reversal of tax credit; or

(ii) inputs destroyed in fire accident or lost while in storage even before use in the manufacture of final products; or

(iii) inputs damaged in transit or destroyed at some intermediary stage of manufacture.

Related Topic:

Karnataka HC Order in the case of M/s Global International

The Decision of the Court:

In the light of the discussion as above, I am of the view that the reversal of ITC involving Section 17(5)(h) by the revenue, in cases of loss by consumption of input which is inherent to manufacturing loss is misconceived, as such loss is not contemplated or covered by the situations adumbrated under Section 17(5)(h).

The impugned orders to the above extent are set aside. Writ Petitions in W.P.Nos.2888, 2890, and 3936 of 2020 are partly allowed and W.P.Nos.2885, 3930 and 3933 of 2020 are allowed in full. No costs. Connected Miscellaneous Petitions are closed.

Related Topic:

Madras HC in the case of M/s. Jayachandran Alloys (P) Ltd.

Read & Download the Full order in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.