CBDT Notified Rule 8AB

Notification No. 76/2021

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 2nd July 2021

G.S.R. 470(E).—In exercise of the powers conferred by section 48 read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules,1962, namely:─

1. Short title:- (1)These rules may be called the Income-tax Amendment (18th Amendment), Rules, 2021.

2. In the Income-tax Rules, 1962, (hereinafter referred to as the principal rules) in rule 8AA, after sub-rule (4), the following sub-rule shall be inserted, namely:- ―

(5). In case of the amount which is chargeable to income-tax as income of specified entity under subsection (4) of section 45 under the head “Capital gains”,-

(i) the amount or a part of it shall be deemed to be from the transfer of short term capital asset if it is attributed to,-

(a) a capital asset which is a short term capital asset at the time of taxation of amount under subsection (4) of section 45; or

(b) capital asset forming part of a block of asset; or

(c) the capital asset being a self-generated asset and self-generated goodwill as defined in clause (ii) of Explanation 1 to sub-section (4) of section 45; and

(ii) the amount or a part of it shall be deemed to be from the transfer of long term capital asset or assets if it is attributed to a capital asset that is not covered by clause (i) and is a long term capital asset at the time of taxation of amount under sub-section (4) of section 45.”.

Related Topic:

CBDT grants further relaxation in electronic filing of Income Tax Forms 15CA/15CB

3. In the principal rules, after rule 8AA, the following rule shall be inserted, namely:—

“8AB. Attribution of income taxable under sub-section (4) of section 45 to the capital assets remaining with the specified entity, under section 48.-

(1) For the purposes of clause (iii) of section 48, where the amount is chargeable to income-tax as income of specified entity under sub-section (4) of section 45, the specified entity shall attribute such amount to capital asset remaining with the specified entity in a manner provided in this rule.

(2) Where the aggregate of the value of money and the fair market value of the capital asset received by the specified person from the specified entity, in excess of the balance in his capital account, chargeable to tax under sub-section (4) of section 45, relates to revaluation of any capital asset or valuation of a self-generated asset or self-generated goodwill, of the specified entity, the amount attributable to the capital asset remaining with the specified entity for purpose of clause (iii) of section 48 shall be the amount which bears to the amount charged under subsection (4) of section 45 the same proportion as the increase in, or recognition of, the value of that asset because of revaluation or valuation bears to the aggregate of increase in, or recognition of, the value of all assets because of the revaluation or valuation.

(3) Where the aggregate of the value of money and the fair market value of the capital asset received by the specified person from the specified entity, in excess of the balance in his capital account, charged to tax under sub-section (4) of section 45 does not relate to the revaluation of any capital asset or valuation of a self-generated asset or self-generated goodwill, of the specified entity, the amount charged to tax under sub-section (4) of section 45 shall not be attributed to any capital asset for the purposes of clause (iii) of section 48.

(4) Notwithstanding anything contained in sub-rules (2) or (3), where the aggregate of the value of money and the fair market value of the capital asset received by the specified person from the specified entity, in excess of the balance in his capital account, charged to tax under sub-section (4) of section 45 relate only to the capital asset received by the specified person from the specified entity, the amount charged to tax under sub-section (4) of section 45 shall not be attributed to any capital asset for the purposes of clause (iii) of section 48.

(5) The specified entity shall furnish the details of the amount attributed to the capital asset remaining with the specified entity in Form No. 5C.

(6) Form No. 5C shall be furnished electronically either under digital signature or through electronic verification code and shall be verified by the person who is authorized to verify the return of income of the specified entity under section 140.

(7) Form No. 5C shall be furnished on or before the due date referred to in Explanation 2 below subsection (1) of section 139 for the assessment year in which the amount is chargeable to tax under subsection (4) of section 45.

(8) The Principal Director General of Income-tax (Systems) or the Director-General of Income-tax (Systems), as the case may be, shall –

(i) specify the procedure for filing Form No. 5C;

(ii) specify the procedure, format, data structure, standards, and manner of generation of electronic verification code, referred to in sub-rule (6), for verification of the person furnishing the said Form; and

(iii) be responsible for formulating and implementing appropriate security, archival, and retrieval policies in relation to the Form No 5C so furnished.

Related Topic:

Goodwill is IPR?

Explanation 1: For the purposes of this rule, the amount chargeable to tax under sub-section (4) of section 45 shall relate to the revaluation of any capital asset or valuation of a self-generated asset or self-generated goodwill, of the specified entity, if the revaluation is based on a valuation report obtained from a registered valuer as defined in clause (g) of rule 11U.

Explanation 2: For the removal of doubt it is clarified that revaluation of an asset or valuation of a self-generated asset or self-generated goodwill does not entitle the specified entity for the depreciation on the increase in value of that asset on account of its revaluation or recognition of the value of a self-generated asset or self-generated goodwill due to its valuation.

Explanation 3: For the purposes of this rule, the expressions “self-generated asset”, and “self-generated goodwill” shall have the same meaning as assigned to them in clause (ii) of Explanation 1 to sub-section (4) of section 45.”.

- In the principal rules, in Appendix II, after Form No. 5B, the following Form shall be inserted, namely:––

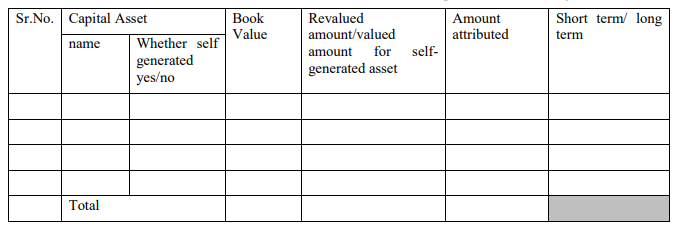

“Form No. 5C (See rule 8AB) Details of the amount attributed to capital asset remaining with the specified entity

1. Name of the specified entity

2. Permanent Account number

3. Assessment Year

4. Amount taxable under sub-section (4) of section 45

5. Attribution of amount taxable under sub-section (4) of section 45 to capital assets remaining

- Name and registration number of the valuer based on whose valuation report information at serial no 5 is provided.

VERIFICATION

I, ____________________________________________son/ daughter of __________________________________ solemnly declare that to the best of my knowledge and belief, the information given in the form is correct and complete and is in accordance with the provisions of the Income-tax Act, 1961. I further declare that I am furnishing the form in my capacity as ___________ (drop down to be provided in e-filing utility) and I am also competent to furnish this form and verify it. I am holding permanent account number ____________.

Place:

Date:

Signature……………….”.

[Notification No. 76/2021/F. No. 370142/22/2021-TPL]

ANKIT JAIN, Under Secy.

Note: The principal rules were published in the Gazette of India, Extraordinary, Part-II, Section-3, Sub-section (ii) vide number S.O. 969 (E), dated the 26th March 1962 and last amended vide notification number G.S.R. 395 (E), dated 8th June 2021.

Related Topic:

CBDT guidelines for manual selection of returns for detailed scrutiny

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.