Karnataka AAR Ruling in the case of Airbus Group India Private Limited

Table of Contents

Case Covered:

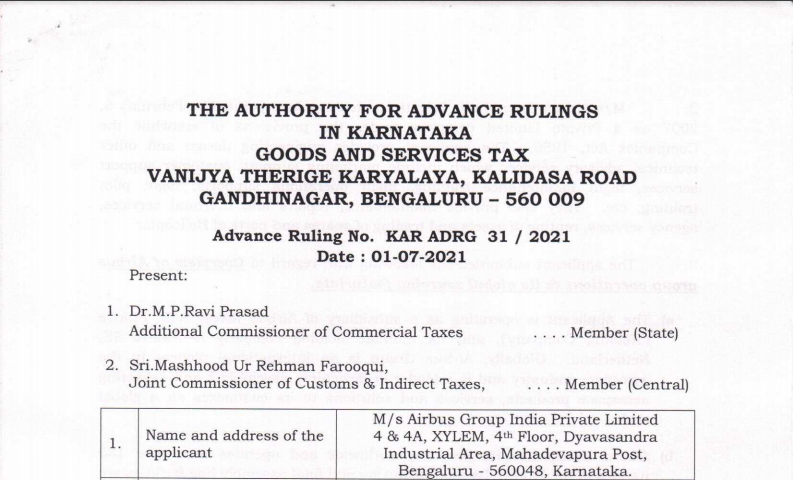

Airbus Group India Private Limited

Facts of the case:

M/s Airbus Group India Private Limited, (hereinafter referred to as the Applicant ‘or’ Airbus India ‘or the Company’), 4 & 4A, XYLEM, 4th Floor, Dyavasandra Industrial Area, Mahadevapura Post, Bengaluru 560048, Karnataka having GSTIN 29AAGCA1513RIZD, has filed an application for Advance Ruling under Section 97 of the CGST Act, 2017 read with Rule 104 of CGST Rules 2017 and Section 97 of KGST Act, 2017 read with the KGST Rules 2017, in FORM GST ARA-01 discharging the fee of Rs. 5,000 / – each under the CGST Act and the KGST

M/s Airbus Group India Private Limited was incorporated on February 6, 2007, as a Private Limited company under the provisions of erstwhile the Companies Act, 1956. The applicant provides engineering design and other technical advisory services which include marketing support, customer support services, flight maintenance training, flight operations supports, flight pilot training, etc. They also provide maintenance, repairs, and overhaul services, agency services, renting of assets, and trading of spares and parts of Helicopter.

The applicant is operating as a subsidiary of Airbus Invest SAS, France (‘Holding Company’), and its ultimate holding company is Airbus SE, Netherland. Globally, Airbus Group is an international pioneer in the aerospace industry and is a leader in designing, assembling, and delivering aerospace products, services, and solutions to its customers on a global scale.

Airbus Group has its presence worldwide and operates from over 130 nations of the world. Its manufacturing and final assembly line facilities are located in various countries such as France, Germany, Spain, the United Kingdom, the United States, and the people’s Republic of China.

Airbus Group procures parts and components or services which are required for its manufacturing operations (i.e. aerospace products and final assembly lines (i.e. Aircrafts, helicopters, etc.)) are generally sourced from both domestic and international markets including the Indian market since such a sourcing strategy ensures competitive advantages to Airbus Group while ensuring the on-time and on-quality delivery of the product to the final customers as well as in providing the best value to its customers.

For sourcing various goods and services, Airbus Group is dependent on numerous key suppliers and subcontractors to provide it with the raw materials, parts, assemblies, systems, equipment, and services that it needs to manufacture its products. Over the years, its global sourcing footprints has expanded across the globe including North America, South America, Europe, Africa, Middle East, and other Asia-pacific regions including India.

Additionally, to promote further globalization of its sourcing footprint, Airbus has established regional offices across multiple countries such as North America, China & East Asia, and India.

Observations:

We observe that the applicant is of the opinion that the activities undertaken by them are classifiable under Heading 9983 with the description of Other professionals, technical and business services. As per the explanatory notes to the scheme of classification of services, heading 998399 offers the same description. This heading includes specialty design services including interior design, design originals, scientific and technical consulting services, an original compilation of facts/information services, translation services, trademark services, and drafting services. It is clearly evident from para 7 above and from the contract agreement that the applicant does not deal with the activities mentioned in the HSN 998399.

Now, we proceed to examine whether the activities undertaken by the applicant can be called intermediary services. The intermediary is defined, under Section 2 (13) of IGST Act, 2017, as a broker, an agent or any other person, by whatever name called, who arranges or facilitates the supply of goods or services or both, or securities, between two or more persons, but does not include a person who supplies such goods or services or both or securities on his own account In this regard, we notice that the applicant has emphasized upon not being an agent or a broker. We notice that there can be differences between agent, broker, and intermediary. Whereas in the case of an agent or broker, activity is undertaken on another’s behalf which is not necessary in the case of an intermediary. Therefore, the reliance on principal to principal relationship or calling oneself as an independent contractor is not relevant for purpose of determining an intermediary as per the definition. An intermediary will merely facilitate or arrange the supply of goods or services between two or more people but will not be providing such supplies on his own account of her. Here, the word, ‘such’ is of paramount importance. Such ‘goods in the present case are the raw materials supplied by the vendors to Airbus Invest SAS, France.

We find that Export of service is defined, under Section 2 (6) of the IGST Act, 2017, as under:

2(6) -export of services means the supply of any service when, – (i) the supplier of service is located in India; (ii) the recipient of service is located outside India; iii) the place of supply of service is outside India; (iv) the payment for such service has been received by the supplier of service in convertible foreign exchange for in Indian rupees wherever permitted by the Reserve Bank of India) 2; and (v) the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8;

The services of the applicant are covered under intermediary services, as concluded at para 17 above and hence the place of supply is India in terms of Section 13 (8) of the IGST Act 2017. Thus the activities of the applicant are demandable to GST at the rate of 18% in terms of clause (iii) of entry no. 23 of Notification No. 11/2017-Central Tax (R) dated 06.28.2017.

In view of the foregoing, we the following

Ruling:

1. The activities carried out in India by the Applicant would constitute a supply as “Intermediary services” classifiable under SAC 998599.

2. The services rendered by the Applicant do not qualify as ‘export of services’ in terms of sub-section 2 of Section 6 of the IGST 2017 and consequently, are required to GST at the rate of 18% in terms of clause (iii) of entry no. 23 of Notification No. 11/2017-Central Tax (R) dated 06.28.2017.

Read & Download the full Copy in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.