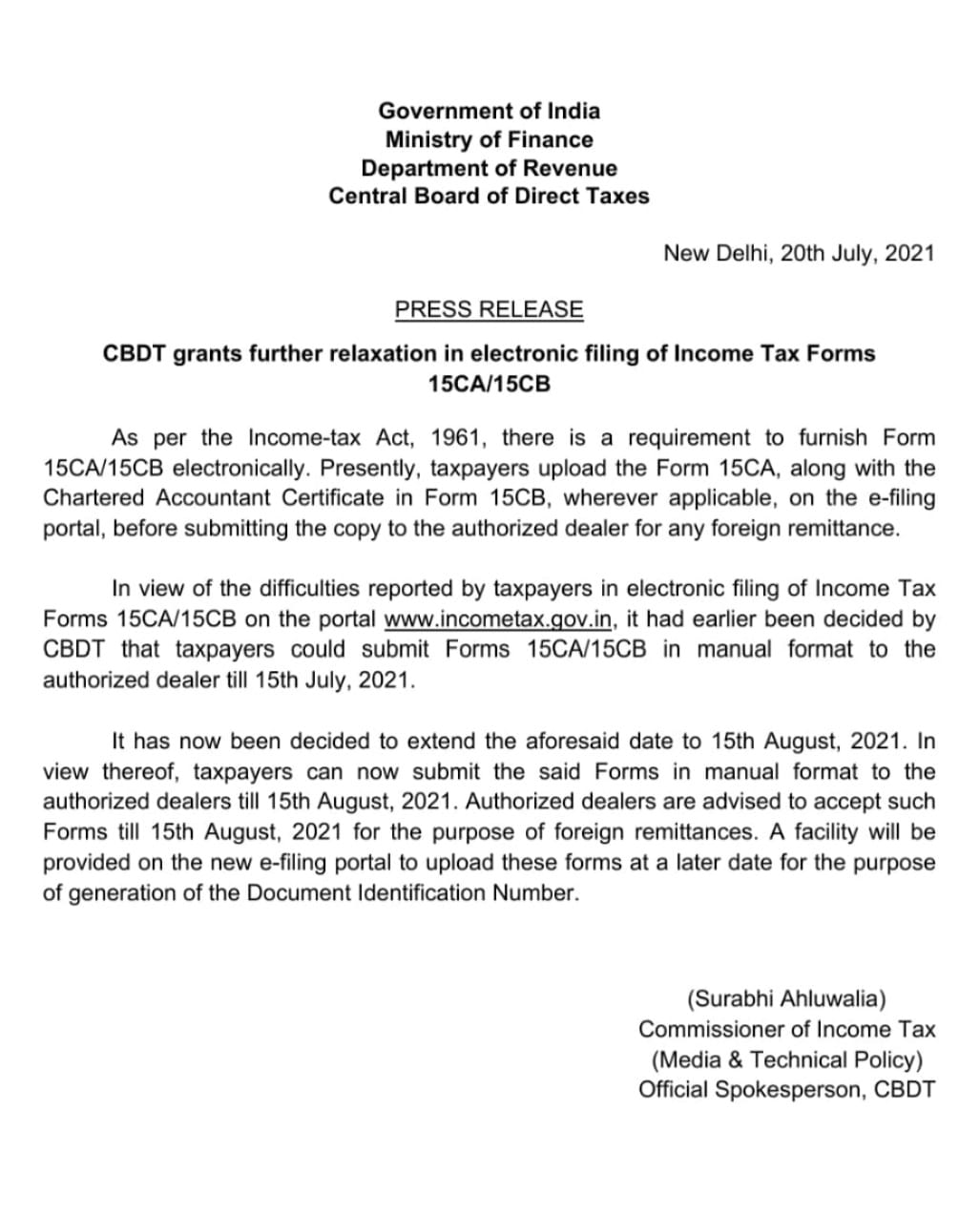

CBDT grants further relaxation in electronic filing of Income Tax Forms 15CA/15CB

As per the Income-tax Act, 1961, there is a requirement to furnish Form 15CA/15CB electronically. Presently, taxpayers upload the Form 15CA, along with the Chartered Accountant Certificate in Form 15CB, wherever applicable, on the e-filing portal, before submitting the copy to the authorized dealer for any foreign remittance.

Related Topic:

Income Tax Informants Rewards Scheme, 2018: CBDT

In view of the difficulties reported by taxpayers in electronic filing of Income Tax Forms 15CA/15CB on the portal of income tax, it had earlier been decided by CBDT that taxpayers could submit Forms 15CA/15CB in manual format to the authorized dealer till 15th July, 2021.

Related Topic:

Download List of GST Forms

It has now been decided to extend the aforesaid date to 15th August 2021. In view thereof, taxpayers can now submit the said Forms in manual format to the authorized dealers till 15th August 2021. Authorized dealers are advised to accept such Forms till 15th August 2021 for the purpose of foreign remittances. A facility will be provided on the new e-filing portal to upload these forms at a later date for the purpose of generation of the Document Identification Number.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.