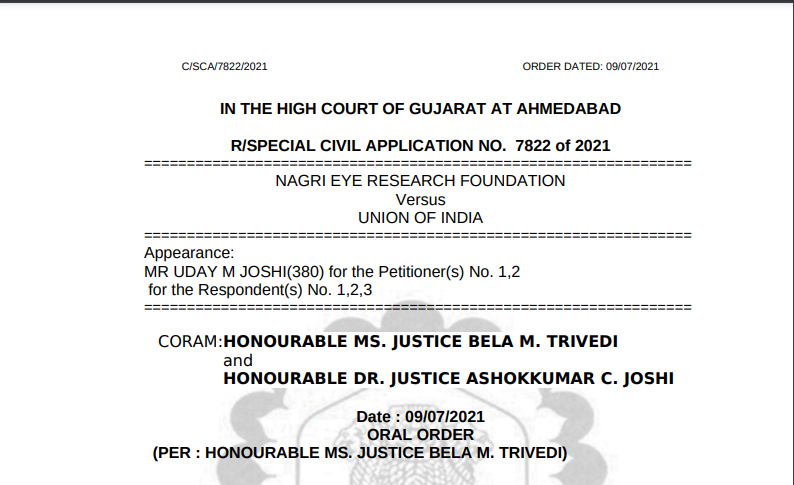

Gujarat HC Order in the case of Nagri Eye Research Foundation Versus Union Of India

Table of Contents

Case Covered:

Nagri Eye Research Foundation

Versus

Union Of India

Facts of the Case:

The petitioner No.1 – Nagri Eye Research Foundation through the petitioner No.2 – its Secretary has challenged the impugned order dated 28.01.2021 passed by the Gujarat Appellate Authority for Advance Ruling, Goods and Service Tax, (hereinafter referred to as ‘GAAAR’), whereby the GAAAR has confirmed the Advance Ruling dated 19.05.2020 given by the Gujarat Authority for Advance Ruling, (hereinafter referred to as ‘GAAR’) while rejecting the appeal of the petitioner No.1 – Nagri Eye Research Foundation.

As per the case of the petitioner, petitioner No.1 is a registered charitable Trust set up with various objectives basically and essentially of undertaking eye and research activities to be carried out by C.H. Nagri Municipal Hospital as well as procurement and management of funds for the purpose of education and charitable activities in eye research and prevention of blindness. Petitioner No.2 is the Secretary of petitioner No.1. It is further the case of the petitioners that the petitioner trust is also running a medical store where the medicines to the indoor and outdoor patients of the petitioner Hospital are sold at a lower rate. Whatever marginal/little difference in terms of excess of income over expenditure is earned, the same is used only for the purpose of mitigating any unforeseen eventualities and/or administrative expenses.

The petitioner Trust had filed an application before the GAAR under Section 97 of the Central Goods and Services Tax Act, 2017 (hereinafter referred to as the CGST Act) seeking advance ruling on the following questions:-

“(i) GST Registration is required for a medical store run by Charitable Trust? and

(ii) Medical store providing medicines at a lower rate is it amounts to the supply of goods?”

The GAAR vide the Advance ruling dated 19.05.2020 came to the conclusion that the petitioner Trust was required to obtain GST Registration for the medical store run by the Trust and that the medical store providing medicines at a lower rate amounted to supply of goods. Being aggrieved by the said Advance ruling given by the GAAR, the petitioners had preferred an Appeal before the GAAAR under Section 107 of the Act. The GAAAR vide the impugned order dated 28.01.2021 dismissed the said Appeal and confirmed the findings recorded by the GAAR. The aggrieved petitioners have preferred the present petition, invoking the extraordinary jurisdiction of this Court under Article 226 of the Constitution of India.

Related Topic:

Prashanti Medical Services & Research Foundation

The learned Advocate Mr. Uday M. Joshi appearing for the petitioners vehemently submitted that both the authorities have failed to appreciate the fact that the activities carried on by the petitioner Trust by running a medical store could not be said to be a “business” within the meaning of Section 2(17) of the CGST Act, inasmuch such activities can neither be said to be a trade or commerce nor for any pecuniary benefit. He submitted that considering the objectives of the Trust also, the petitioner Trust could not be said to be running a medical store for profit by any stretch of the imagination. Taking the Court to the definition of the word ‘business’ as defined under Section 2(17) of the CGST Act, Mr. Joshi submitted that since the activities of the petitioner Trust could not fall in the first part of the definition, i.e. trade or commerce, the application of the second part of the definition would not arise. He also drew the attention of the Court to the grounds mentioned in the petition to submit that the petitioners give benefits to patients under various schemes floated by the Central / State Government and in such a situation, also the activity could not be said to be a business activity.

In order to appreciate the contention raised by learned Advocate Mr. Joshi, it would be beneficial to reproduce the relevant portion pertaining to the “scope of supply” as contained in Section 7(1) of the CGST Act. The relevant part is reproduced as under:-

“Scope of supply.

7. (1) For the purposes of this Act, the expression “supply” includes –

(a) all forms of supply of goods or services or both such as sale, transfer, barter, exchange, license, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business;

(b) import of services for a consideration whether or not in the course or furtherance of business, [and]

(c) the activities specified in Schedule I, made or agreed to be made without a consideration.”

Section 22(1) of the CGST Act mandates that every supplier is liable to be registered under the Act in the State or Union territory, other than special category States, from where he makes a taxable supply of goods or services or both if his aggregate turnover in a financial year exceeds twenty lakh rupees, provided that where such person makes taxable supplies of goods or services or both from any of the special category States, he shall be liable to be registered if his aggregate turnover in a financial year exceeds ten lakh rupees.

Since Mr. Joshi has emphasized that the activity carried on by the medical store of the petitioner Trust could not be said to be a “business”, it would be beneficial to refer to the relevant part of the definition of the word ‘business’ as contained in Section 2(17) of the said Act which reads as under:-

“(17) “business” includes –

(a) any trade, commerce, manufacture, profession, vocation, adventure, wager or any other similar activity, whether or not it is for a pecuniary benefit;”

Having regard to the aforestated provisions contained in the said Act, there remains no doubt that every supplier who falls within the ambit of Section 22(1) of the Act has to get himself registered under the Act. As per Section 7(1) of the Act, the expression ‘supply’ includes all forms of supply of goods and services or both such as sale, transfer, barter, etc. made or agreed to be made for a consideration by a person in the course or furtherance of business. It is not disputed that the petitioners are selling the medicines, maybe at a cheaper rate but for consideration in the course of their business. The submission of Mr. Joshi that such a sale could not said to be a “business” in view of the definition contained in Section 2(17) of the said Act cannot be accepted. As per the said definition, the ‘Business’ means any trade or commerce any trade, commerce, manufacture, profession, vocation, adventure, wager, or any other similar activity, whether or not it is for a pecuniary benefit. From the bare reading of the said definition, it clearly emerges that any trade or commerce whether or not for a pecuniary benefit, would be included in the term ‘business’ as defined under Section 2(17) of the said Act. Mr. Joshi has failed to substantiate or justify his submission as to how such activity of selling medicines to the patients for consideration could not be said to be trade or commerce. For the purpose of “business” under Section 2(17) of the Act, it is immaterial whether such trade or commerce or such activity is for the pecuniary benefit or not.

Both the authorities have in detail considered the submissions and the issues raised by the petitioner Trust and held that the Medical Store run by the Charitable Trust would require GST Registration and that the Medical Store providing medicines even if supplied at a lower rate would amount to supply of goods. The Court does not find any illegality or infirmity in the said orders passed by the authorities.

In that view of the matter, the petition being devoid of merits is dismissed in limine.

Read & Download the Order in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.