A petitioner who seeks equity must do equity

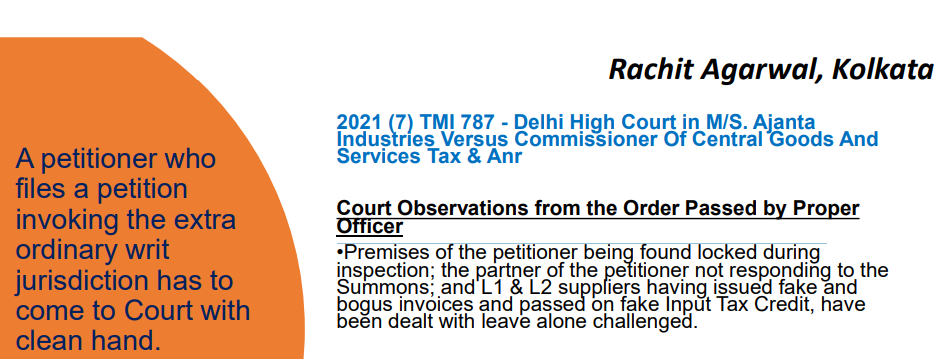

A petitioner who files a petition invoking the extraordinary writ jurisdiction has to come to Court with a clean hand.

Further, a petitioner who seeks equity must do equity

2021 (7) TMI 787 – Delhi High Court in M/S. Ajanta Industries Versus Commissioner Of Central Goods And Services Tax & Anr

Table of Contents

Court Observations from the Order Passed by Proper Officer

• Premises of the petitioner being found locked during inspection; the partner of the petitioner not responding to the Summons, and L1 & L2 suppliers having issued fake and bogus invoices and passed on fake Input Tax Credit, have been dealt with leave alone challenged.

Order of Hon’ble Court

The court may have to grant relief if all the ingredients of a statutory provision are satisfied

Consequently, this Court believes it would not be appropriate to entertain the present writ petition.

Conclusion

The principles established by the Hon’ble Delhi High Court in the case of M/S. Ajanta Industries versus Commissioner of Central Goods and Services Tax & Anr. reiterate that petitioners must approach the court with clean hands and fulfill all statutory requirements. The Court, while observing discrepancies such as locked premises, unresponsive partners, and fake invoices, highlighted that statutory provisions must be satisfied before granting relief.

This judgment underscores the importance of transparency and compliance when invoking the court’s extraordinary writ jurisdiction. For individuals dealing with legal challenges, consulting experts, such as personal injury lawyers or other legal professionals, can provide the necessary guidance to ensure proper adherence to legal protocols.

Read & Download the Order in pdf:

CA Rachit Agarwal

CA Rachit Agarwal