Direct Tax Proposals Budget 2022

Table of Contents

Tax Rates Related Amendments

The Budget backed no major changes in the tax rates for taxpayers, except for a few minor changes for specific classes of incomes and specific classes of taxpayers.

Taxation of Co-operative Societies

- Surcharge applicable on Co-operative societies

- As per provisions of Section 115JC, the Cooperative Society is liable to pay Alternative Minimum Tax (AMT) at 18.5%. Also, if the income of the Cooperative Society exceeds INR 1 crore, the surcharge rate is 12%.

- As per the proposed amendment, the AMT has been lowered from 18.5 to 15%. Also, the surcharge shall be 7% (in case of income between 1 crore to 10 crores) and 12 % (in case of income exceeding 10 crores).

Miscellaneous Changes in Tax Rates and related provisions Dividend from Foreign Companies

- As per the provisions of Section 115BBD, dividend income received by an Indian company from a foreign company, in which the said company has a shareholding of more than 26%, then such dividend shall be taxable at the rate of 15%.

- As per the proposed amendment, the provisions of said Section shall not be applicable for the dividend received after 01.04.2023. Hence, the said dividend shall be taxable at the applicable tax rate.

Miscellaneous Changes in Tax Rates and related provisions Lower Tax Rate of Manufacturing Companies

- Section 115BAB provides for an option of concessional rate of taxation @15% for new domestic manufacturing companies subject to fulfillment of certain other conditions.

- One of the conditions was that the company is required to commence manufacturing or production on or before 31st March 2023.

- The sunset date of incorporation has been proposed to be extended to 31st March 2024.

- These amendments will take effect from AY 2022-23.

Miscellaneous Changes in Tax Rates and related provisions Tax Benefits for Start-Ups

- Currently, an eligible start-up subject to satisfying certain conditions can claim a deduction of an amount equal to 100% of the profits and gains derived from an eligible business for three consecutive assessment years out of 10 years u/s 80IAC.

- One of the conditions was that the eligible start-up shall be incorporated on or after 1st April 2016 but before 1st April 2022.

- The sunset date of incorporation has been proposed to be extended to 31st March 2023.

This amendment will take effect from AY 2022-23.

Amendments related to Personal Taxation

Exemption for Covid-19 Medical Assistance

In order to codify these changes, section 17 and section 56(2)(x) have been amended.

- A new sub-clause has been inserted to the first proviso to section 17 to provide that any sum paid by the employer in respect of expenditure actually incurred by the employee on his medical treatment or treatment of any family member in respect of illness relating to Covid-19, shall not be taxed as a prerequisite.

- Two clauses were added in section 56(2)(x) to provide exemptions for the following amounts:

-An individual receiving reimbursement of Covid related expenses incurred by him for himself or any of his family members whether by his employer or any other person

-Amount received by a member of the family of the deceased person where the cause of death is an illness related to Covid-19 and the payment is received within 12 months from the death of the individual

– From employer

– From any other person subject to a maximum of INR 10 Lakhs

80CCD-Employer Contribution to National Pension Scheme

- As per section 80CCD, the deduction of the employer’s contribution was limited to 10% of the salary of the employee for the respective year.

- This limit was increased from 10% to 14% in the case of Central Government Employees, from AY 2020-21 onwards, however, in the case of other employees the limit continued to be 10%.

- In a view to bringing State Government employees at par with Central Government employees, it has been proposed to increase the limit of deduction under Section 80CCD from 10% to 14% on employer’s contribution to the NPS account of State Government employees.

- This amendment will take effect retrospectively from AY 2020-21.

80DD-Annuity to Disabled Person

- Currently, a deduction of INR 75,000/1,25,000 is allowed to a taxpayer for expenditure incurred for the medical treatment of a disabled dependant or for the amount paid as a premium to the insurance company.

- Sub-section provided that the deduction shall only be allowed if payment of premium is in respect of the policy which provides for payment of annuity/lump-sum amount for the benefit of disabled dependent only in the event of the death of the individual or HUF in whose name subscription has been made.

- Therefore, as per current law, under section 80DD is allowed only if the premium has been paid for a scheme that provides annuity or lump sum amount after the death of such individual.

- Now it has been proposed to allow the deduction of any sum paid for a scheme wherein the payment of annuity and lump sum amount will be received by differently-abled dependent during the lifetime of parents/guardians, i.e., on parents/ guardians attaining the age of sixty years. Further, sub-section (3) shall not apply to the aforesaid amount received by the dependant before his death.

- This amendment will take effect from 1st April 2023.

Taxation of Virtual Digital Assets

Section 2(47A)- Definition of Virtual Digital Assets Introduced

Includes code or number or token (not being Indian or foreign currency) generated through cryptographic means or otherwise and includes Non-Fungible Tokens (NFTs) or any other token of similar nature.

Section 115BBH (Applicable from AY 2023-24)

- Income from transfer of Virtual Digital shall be taxed at flat 30% plus applicable surcharge and cess.

- For Computing income, no expenditure shall be allowed except for the Cost of Acquisition.

- The loss arising from transfer shall not be allowed to be set off against income under any other provision of the Act.

- Loss shall not be allowed to carry forward.

- Even if the Virtual Digital Assets are gifted, it shall be taxable and section 56(2)(x) shall apply for taxing the same.

Section 194-S TDS on transfer of Virtual Digital Assets Applicability

- TDS is applicable on the transfer of Virtual Digital Assets to a resident.

Rate of TDS

- TDS is applicable @ 1% on the transfer of virtual digital assets.

Timing for Deduction of TDS

- TDS is required to be deducted at the time of payment or credit to the account of the payee, whichever is earlier. The account includes ‘Suspense Account’ or any other account by whatever name is called.

- In case the consideration is paid in kind or partly in kind and partly in cash and the amount in cash is not sufficient to meet the TDS liability, the payer shall ensure that tax is paid before payment to the payee.

Thresh-hold Limit

- The Threshold limit in case the payer is a specified person shall be INR 50,000 p.a. and in any other case shall be INR 10,000 p.a.

Other Conditions

- In case 194-S is applicable, no tax is required to be collected or deducted in respect of the said transaction under any other provision.

- In case TDS is applicable u/s 194-O and 194-S on the same transaction, 194-S shall prevail.

- Provisions of section 203A and 206AB shall not be applicable in the case of a Specified Person.

Applicability of Provisions

- The provisions are applicable from July 01, 2022.

Meaning of a Specified Person

- Specified Person means Individual or HUF not having income under the head Business or Profession or Individual or HUF whose total sales or gross receipts or turnover does not exceed INR 1 crore in case of business and INR 50 Lakhs in case of the profession in the preceding FY.

With-Holding Tax-Related Amendments

194-IA-TDS on Sale of Immovable Properties

- Currently, the buyer of immovable property is liable to deduct tax at the rate of 1% on the payment made for the purchase of the property. The threshold for the said section is INR 50,00,000.

- As per the proposed amendment, the value of the property for calculation of the threshold and for deduction of TDS, the value of Stamp Duty shall also be considered.

- 194-R TDS on Benefits or Perquisites for Business and Profession.

Applicability

- As per the Amendment new provision is proposed to be inserted for deduction of tax on any benefit/ perquisite arising out of the business/ profession to a resident.

Rate of TDS

- The tax shall be deducted @ 10% of the value of benefits or perquisites provided.

Timing for deduction of TDS

- The TDS Shall be deducted before the provision of such benefits or perquisites.

Thresh-hold Limit

- TDS shall be deducted if the value of benefits or perquisites exceeds or is expected to exceed INR 20,000 during the financial year.

Non-Applicability

- The provisions of the said proposed provision shall not be applicable to an individual/ HUF, where the business receipts and professional receipts do not exceed INR 1 crore and INR 50 lakh, respectively.

Date of Applicability

- The provisions are applicable from July 01, 2022.

Person Obliged to With-Hold Tax

- Every person providing a benefit or perquisite is required to deduct TDS.

- In case the person provides benefits or perquisites in kind or partly in cash and partly in kind and such part of cash is not sufficient to meet the TDS liability, then the person shall ensure that the TDS is paid before the release of such benefit or perquisites.

206AB/206CCA-TDS in case of Non-Filers of Income Tax Return-01. .04.2022

- Currently, a higher rate of TDS/TCS is applicable (higher than twice the rate of tax or 5%) where the specified person* has not filed its tax returns and the aggregate of TDS/TCS in each of the years exceeds INR 50,000.

- It has been proposed to amend the definition of Specified person to include a person who has not filed the tax return for the AY immediately preceding the previous year in which tax is required to be deducted or collected and the time limit for filing such returns has expired and aggregate TCS/ TCS is more than INR 50,000.

- Also, provisions of higher TDS/TCS have been proposed to be not applicable on section 194-IA, 194-IB, 194M.

239A- Refund of TDS to the deductor

- Currently, the deductor of tax on income payable to nonresidents can file an appeal before CIT(A) for claiming the refund of such tax in case the same is found to be not deductible and such tax was borne by the deductor.

- Now, new provisions have been proposed where an application for refund of such TDS shall now be filed with the Assessing Officer instead of direct appeal to CIT(A).

- An appeal against such order may be filed before Commissioner(Appeals) in case the deductor is aggrieved by the order of Assessing Officer.

Corporate Taxation Amendments

Amendment u/s 14A

- Sec.14A provides that for the purpose of computing total income, no deduction shall be allowed in respect of expenditure incurred in relation to income not forming part of the total income.

- Rule 8D further supplements the calculation of the amount of expenditure to be disallowed u/s 14A.

- Circular No.5 of 2014 was issued which clarified that the legislative intent under section 14A is to disallow the expenditure related to an exempt income irrespective of whether such income has been earned during the year or not.

- However, still, there were a plethora of judgments that held that there can be no case of disallowance if no exemption has been earned during the year.

Amendment u/s 14A

- Finance Bill 2022, proposes to insert an Explanation to provide that section 14A shall apply and be deemed to have always applied even if the exempt income has not accrued/ arisen/ received during the year and expenditure has been incurred during the year in relation to such exempt income.

Section 37- Disallowance of Expenditure

As per section 37 of the Income Tax Act, any expenditure incurred wholly and exclusively for the business or Profession shall be allowed to be deducted to compute income.

Explanation 1 to section 37, currently provides for disallowance for any expenditure incurred for any offense or prohibited by law or compounding off of an offense or providing any benefits or perquisites to any person and such provisionisinprohibitionof law.

There was always an ambiguity regarding the allowability of an expense incurred for an offence under any foreign law or any expense incurred in violation of Indian Medical Council regulations, 2002, it has been proposed to insert a clarificatory explanation to the provisions of the Act, which states that no deduction of aforesaid expense shall be allowed to the taxpayer.

This amendment will take effect from 1st April 2022.

Section 40a(ii)-Health and Education Cess is a Non-Deductible Expenditure

Currently, the basis on the interpretation of various High Courts & ITATs certain taxpayers were taking a deduction of surcharge or cess as allowable expenditure. Considering the above, it has been proposed to amend an Explanation in Section 40 of the Act to clarify that term “tax” includes and shall be deemed to have always included any surcharge or cess, by whatever name called, on such tax.

This amendment will be applicable retrospectively from 1st April 2005 i.e. from A.Y. 2005-06 onwards.

Section 43B- Conversion into Debenture or any other Instrument

The existing provisions of Section 43B provide for deduction of any interest payable as allowable deduction only if such interest has been actually paid.

Conversion of such interest into a loan or borrowing or advance shall not be deemed to have been actually paid.

The clarificatory amendment has been made to include conversion of outstanding interest into debentures is also not an actual payment and hence cannot be claimed as deduction. This amendment will be applicable from AY 2023-24 onwards i.e. 01st April 2023

Provision for filling Updated Return

Section 139(8A)-Provision for filling updated Return

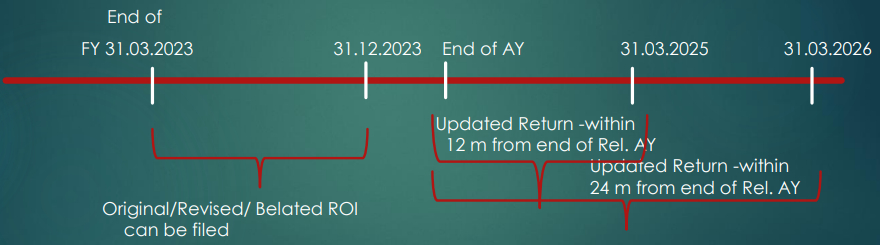

- As per the current law, an assessee can file a revised return or belate it before 3 months from the end of the relevant Assessment Year.

| Particulars | Due date for

original return |

Due date for

revised return |

Additional time

for filling |

| Individuals/ HUF/ other assesses except co. and person required to get A/c Audited | 31st July | 31st December | 5 months |

| Company/ person required to get A/c audited | 31st October | 31st December | 2 months |

| Persons to whom TP Audit is applicable | 30th November | 31st December | 1 month |

- These existing timelines for filing belated or revised returns were inadequate.

Section 139(8A)-Provision for filling updated Return

- Accordingly, a person can file an updated return at any time within 24 months from the end of the relevant Assessment Year.

- This Return can be filed even if ITR was not at all furnished filed u/s 139(1)i.e. original return, or return was already revised u/s139(5) or a belated return was filed u/s139(4).

Section 139(8A)-Provision for filling updated Return

- The provisions of the Updated Tax Return trigger Additional Tax Liability in accordance with section 140B, over and above the normal tax, interest, cess, surcharge, and fees.

- Incase the return isfiledwithin12 months from the end of the relevant Assessment Year, an additional tax of 25% on the amount of incremental Tax, surcharge, cess, and interest shall be payable.

- In case the return is filed within 24 months from the end of the relevant Assessment Year, an additional tax of 50% shall be payable.

- Section 139(9), has been amended to provide that in case the Updated Return is filed, tax payment is required, otherwise, it shall be declared as defective.

Cases where Updated Return cannot be filed

- Tax payers belong to a class notified by CBDT.

- Updated Return results in an increase in loss, decrease in tax liability as compared to original/ revised// belated return, results in a refund or increases refund.

- Assessment has been completed in that case or is pending for assessment.

Section 139(8A)-Provision for filling updated Return

Cases where Updated Return cannot be filed

- Search/ Surveyor Requisition of Books has been conducted in that case.

- Where information is received in respect of the taxpayer by the Assessing Officer under Benami Act, PMLA, Black Money Act, or under section 90/90A or if prosecution is initiated prior to filling of updated return.

Other Amendments in relation to Updated Return

- Amendments made in sections 144, 153 (assessment to be made within 9 months from the end of the FY in which Updated ROI is furnished) and 276CC (prosecution for non-filling of return, not applicable updated Return filed).

Miscellaneous Amendments

Section68- Income from undisclosed sources/ unexplained cash credit

As per the first proviso to section 68, a Closely Held company has to explain the source of source for any credits received in the form of Share Application money, share capital, share premium, or any other amount by whatever name called received from a resident shareholder.

As per the proposed Amendment, a new proviso is added, which has extended the onus to prove to the source of source in respect of all the credits received in the form of loan or borrowing or any other credit to the Books of Account.

This explanation is not required if the funds are received from regulated entities i.e. Venture Capital Companies or Venture Capital Funds referred u/s 10(23)(b).

Insertion of a new section 79A- Set off of Losses consequent to search

No set-off of brought forward loss or unabsorbed depreciation shall be allowed against the undisclosed income determined as a consequence of:

– Search proceedings; or

– Requisition under u/s 132A; or

– Survey under section 133A.

*Undisclosed income has been further defined in explanation to section 79A

Amendment in Reassessment Scheme

As per the current provisions of Section 148A, approval was required from the specified authority for conducting an inquiry w.r.t. to the information that suggested escapement of income; for issuing SCN to the assessee that why a notice u/s 148 shall not be issued in his case; for passing order whether it is a fit case for reopening; and issue of Notice u/s 148 for reopening the case.

As per the amended provisions, no approval shall be required to issue an SCN that why a Noticeu/s 148 should not issue in the case and no approval shall be required for issuance of Notice u/s 148, in case AO has passed an order to the effect that it is a fit case for reopening.

Meaning of the term “Income chargeable to tax has escaped assessment” has been expanded and Explanation 1 to Section 148 has been amended to provide that the definition of information shall now include –

− Any information provided by risk management strategy by the board, or

− Any audit objection, or

− Any information received from a foreign jurisdiction under an agreement or directions contained in a court order, or

− information received under a scheme notified under section 135A

As per the provisions of Section 149, a notice under Section 148 can be issued after three years but before 10 years from the end of AY by the AO (where income exceeds more than INR 50 lakh) based on the books of account in possession of AO or other documents that reveals that income is chargeable to tax. It has been clarified that the income can be represented in the following forms –

– In form of an asset; or

– Expenditure in respect of a transaction or in relation to an event or occasion; or

– An entry or entries in books of accounts

Section 149(1A) has been proposed to be introduced. As per the said Section, where the income of the assessee (case where income is more than INR 50 lakh) is spillover multiple years, then the assessment shall be opened for every year.

Amendments in relation to Charitable Trusts/ Institutions

Amendment in section 11(2) for Income Accumulated for application towards charitable and religious purposes

– Such income were not utilized till the last of the previous years for which such income is so accumulated, shall be taxed in such last of the previous years itself and not in the subsequent previous year; –

– Such income to be also taxed in the year in which it is credited or paid to any trust or fund or university or educational institution or institution as referred to in clause (d) of sub-section (3) of Section 11.

This amendment will take effect from 1st April 2023 i.e., AY 2023-24, and subsequent AYs.

Sum to be considered as an application in the year in which is actually paid by the Trust irrespective of the previous year in which the liability to pay such sum was incurred by the trust or institution according to the method of accounting regularly employed by it;

– Where during any previous year, any sum has been claimed to have been applied by the trust or institution, such sum shall not be allowed as an application in any subsequent previous year.

This amendment will take effect from 1st April 2022 i.e., AY 2022-23, and subsequent AYs.

Itis also proposed to provide that where the total income of any trust or institution, without giving effect to the provisions of section 10/11/12, exceeds the maximum amount which is not chargeable to tax in any previous year, such fund or trust or institution or any university or other educational institution or any hospital or other medical institution, in addition to getting its books of accounts audited shall also, keep and maintain books of account and other documents in such form and manner and at such place, as may be provided by rules.

This amendment will take effect from 1st April 2023 i.e.AY 2023-24, and subsequent AYs.

Amendments in relation to Faceless Assessment

To avoid legal and procedural issues in the implementation of the scheme, it is proposed to substitute the existing Faceless assessment Scheme. Some of the key changes are as under:

- The Assessment Unit (AU) to make a proposal for determination of income/loss (as against the draft order earlier) and provide an opportunity of being heard, in a case where the proposal for income/loss determination leads to variation prejudicial to the Assessee.

- It has been proposed to omit the sub-section (9) which provides for assessment to be avoided if the procedure mentioned in the section is not followed to avoid litigation.

CA Jaya Krishna Kapoor

CA Jaya Krishna Kapoor