ITC in the case of Car Chassis Carriers Private Limited & anr. vs. Assistant Commissioner, College Street and Sealdah Charge

Table of Contents

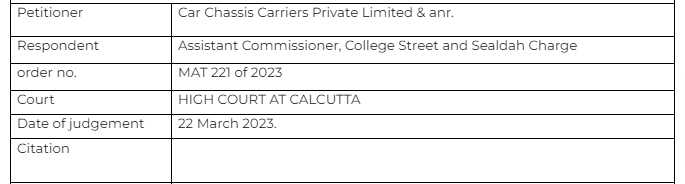

Case Covered:

Car Chassis Carriers Private Limited & anr. vs. Assistant Commissioner, College Street and Sealdah Charge

Facts of the case

The department sent a communication to the appellant to reverse the ITC because the registration of the supplier was canceled. But the details of the supplier1 were not mentioned in the email.

Observations & Judgement of the court

The honorable court said -In our view, the procedure adopted by the authority for directing reversal of the input tax credit and thereafter compelling the appellants to pay the amount is not sustainable in the eye of law but will be in violation of the principles of natural justice. Therefore, we are fully convinced that the manner in which the respondent authority directed the appellants to reverse the input tax credit by way of an email dated 20th December, 2022 is not tenable in law

Read & Download the Full Car Chassis Carriers Private Limited & anr. vs. Assistant Commissioner, College Street and Sealdah Charge

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.