Taxpayer should appear for hearing in case of dual proceedings- TVL Metal

Very controversial issue of GST. Many cases are pending on this issue. Jurisdiction of other authority when the TP is assigned to the other one. In a recent judgment the Madras high court has said that the authority who is assigned the TP can only do the proceedings. Cross empowerment is allowed but in absence of a notification it is not applicable.

Also read- Landmark judgment on jurisdiction of GST authorities

Table of Contents

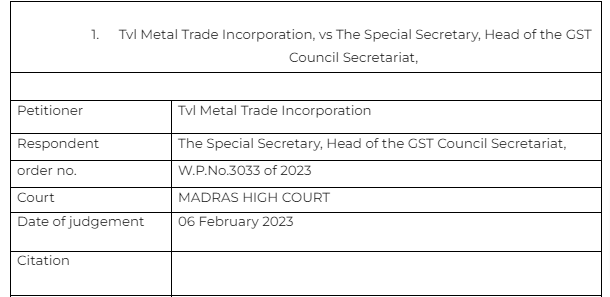

Case Covered:

Tvl Metal Trade Incorporation,

Rep. by its Proprietor,

Vs

The Special Secretary,

Head of the GST Council Secretariat,

Also read- 7 judgments for jurisdiction and cross empowerment

Facts of the case

Court asked the applicant to appear before the authorities in case of jurisdictional issues.

Observations & Judgement of the court

In this case the writ was filed to request the court to drop the notice by authorities asking for some details. The taxpayer said that one enquiry is already in progress relating to that same information. The taxpayer was asked to personally attend the enquiry. The petitioner said that when there is already a set of proceedings is in continuation, he cant be called upon to reply the same issues.

The court asked the appellant to attend the office of department and mention these fact to the authorities. Th court asked him to give his reply and attend personally to authorities. Thus the petition was disposed off.

Read & Download the Full Tvl Metal Trade Incorporation VS The Special Secretary

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.