Registration cant be cancelled on the grounds not mentioned in SCN (Pdf Attach)

Case Covered:

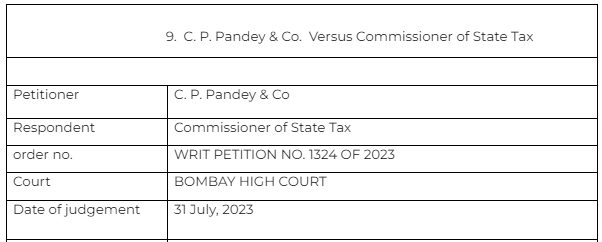

C. P. Pandey & Co. Versus Commissioner of State Tax

Citation:

- Ramji Enterprises & Ors. Vs. Commissioner of State Tax & Ors

- “Monit Trading Pvt. Ltd. Vs. Union of India & Ors

Facts of the case

The registration of the taxpayer was canceled. A prayer to restore the registration was made by the petitioner.

The applicant said that the registration was canceled on the grounds which were not mentioned in the SCN. It is a settled principles of law that an order cannot be passed on a ground which is not a ground in the show cause notice, as no opportunity was available to the petitioner to meet such grounds, which emerge for the first time in the orders passed, at the final adjudication of the show cause notice. The case of Ramji Enterprises & Ors. Vs. Commissioner of State Tax & Ors. and “Monit Trading Pvt. Ltd. Vs. Union of India & Ors. were referred

Observations & Judgement of the court

The court agreed to the arguments of the petitioner. The court found that the decision in Ramji Enterprises & Ors. was rendered in similar circumstances as in the present case, when the Court set aside the orders canceling registration.

Read & Download the Full C. P. Pandey & Co. Versus Commissioner of State Tax

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.