(Pdf Attact) The benefit of scheme of restoration of registration should be given to all taxpayers

Case Covered:

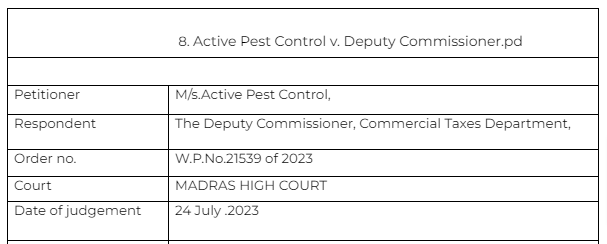

Active Pest Control v. Deputy Commissioner.

Citation:

1. Suguna Cutpiece Centre Vs. The Appellate Joint Commissioner of GST

Facts of the case

In this the registration of petitioner was canceled. The scheme of government provided the amnesty to apply for revocation of cancellation of registration in case the registration was canceled upto .

Observations & Judgement of the court

The court said “The Government had itself recognized the difficulties of assessees and had given a amnesty scheme vide Notification No.03/2023 – Central Tax dated 31.03.2023. By virtue of the aforesaid scheme, assessee’s registration whose registrations were cancelled before 31.12.2022 given a reprieve. “

The above Scheme has been now extended up to 31.08.2023 vide Notification No.23/2023 – Central Tax, dated 17.07.2023. Although the above scheme applies to those whose registrations were cancelled before 31.12.2022, the intention of the Government is to allow the registrants, whose registration have been revoked to revive their registration to carry on the business

Thus the benefit of the scheme was provided to the petitioner also.

Read & Download the Full Active Pest Control v. Deputy Commissioner.

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.