Period from 15.03.2020 till 28.02.2022 ought to be excluded from limitation- Alagu kannan (PDF attached)

Table of Contents

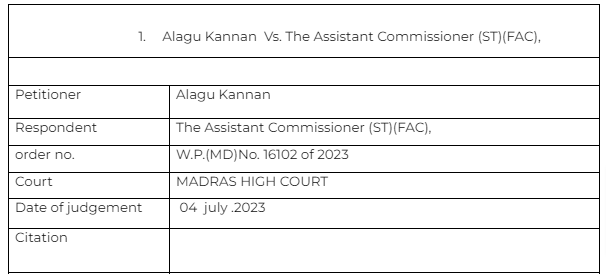

Case Covered:

Alagu Kannan Vs. The Assistant Commissioner (ST)

Facts of the case

The writ petition was filed challenging the impugned Assessment order, dated 09.03.2023. The taxpayer was registered in earlier tax regime also. At the time of transition into the GST, the CENVAT was written in TNVAT by mistake. It was entered in column no. 5(c) in place of column 7(A) of TRAN 1. Meanwhile the notice was sent and order was passed. The taxpayer came to know his mistake on receiving the notice only. He filed a rectification but it was rejected as time barred. The applicant came to the court to quash the notice.

Observations & Judgement of the court

The honorable SC wide their suo moto order excluded the period from 15.03.2020 to 06.04.2020. Considering the above facts the court allowed the writ petition. The impugned order was quashed and authorities were asked to listen to the side of appellent.

Read & Download the Full Alagu Kannan Vs. The Assistant Commissioner (ST)

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.