No penalty of E way bill when goods pass through the state and there is no evasion. (Pdf Attach)

Table of Contents

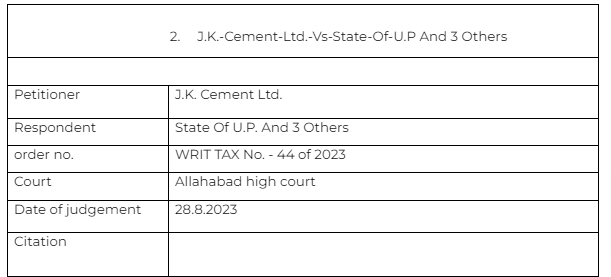

Case Covered:

J.K. Cement Ltd. Vs State Of U.P And 3 Others

Facts of the case

The petitioner being registered company incorporated under the Companies Act, 1956 is engaged in the manufacture and sale of cements, wall putty, adhesives etc. The petitioner is duly registered under the Goods and Services Tax Act and paying the taxes as and when its due. In the normal course of business, the petitioner has sent five consignments of J.K. Cement White MaxX Premium White Portland Cement, J.K. Cement WallmaxX putty and J.K. MaxX waterproof Putty and five invoices were also issued. The said goods were transported from Gwalior to Panna, Madhya Pradesh by which two G.R. number i.e. 612 and 611 were also issued in which vehicle number was also mentioned as MP 20 HB4370. But during the course of that they had to get passed from Jhansi(UP) for a short distance.

- The E-way bill liability in MP was exempted on the same goods.

- The goods were intercepted at UP for not having the E–way bill.

- A penalty was levied on the taxpayer and they filed this writ to get a breather from the penalty.

Observations & Judgement of the court

The court held that there was no requirement of E-way bill in MP. Good were detained in the short span of Jhansi,(UP)

The court said that there is no intent to evade the tax. The writ was allowed. The impugned orders are set aside. Any amount already deposited by the petitioner during pendency of the present litigation, shall be refunded to him within a period of 20 days from the date of production of certified copy of this order before the authority concerned

Read & Download the Full J.K. Cement Ltd. Vs State Of U.P And 3 Others

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.