Rs. 5000 cost was levied on officer for not providing Opportunity of being heard- Jupiter Exports (PDF Attached)

Table of Contents

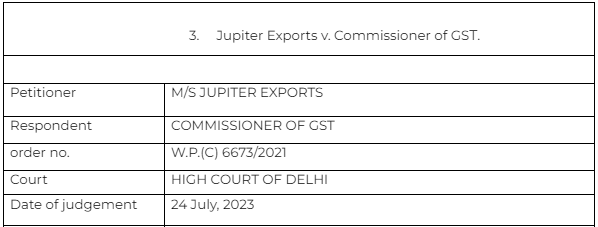

Case Covered:

Jupiter Exports v. Commissioner of GST

Citation:

1. Amman Match Company v. Assistant Commissioner of GST & C. Ex.

2. BA Continuum India Pvt. Ltd. v. Union of India and Others

3. Service Pvt. Ltd. v. Union of India

4. National Highways Authority of India & Ors. v. Madhukar Kumar & Ors

5. A.S. Motors Pvt. Ltd. v. Union of India Ors

6. Maharashtra State Board of Secondary & Higher Secondary Education v. K.S. Gandhi & Ors

7. Rao Shiv Bahadur Singh and Another v. The State of Vindhya Pradesh

8. Whirlpool Corporation v. Registrar of Trademarks

9. Godrej Sara Lee Ltd. v. Excise and Taxation Officer-cum-Assessing Authority and Others

10. State of Uttar Pradesh v. Mohd. Nooh: 1958 SCR 595

Facts of the case

A demand order dated 25.03.2021, passed by the respondent under Section 74(9) of the Central Goods and Services Tax, 2017 (hereafter ‘the CGST Act’), raising a total demand of ₹6,67,74,062/-, which includes the tax amount of ₹2,88,90,416/-, interest for a sum of ₹89,93,230/-, and penalty to the tune of ₹2,88,90,416/- for the tax period of April 2018 to March 2019.

The petitioner claimed that the impugned order is passed against the principles of natural justice and requested the court to quash it. The respondent further submits that the present case is an admitted case where the petitioner has violated the provisions of the CGST Act. The petitioner had nothing more to argue than what was contended in the reply to the Show Cause Notice. The reply was considered by the Adjudicating Authority and a reasoned order had been passed and therefore, the petitioner cannot be allowed to contend that by not being granted an opportunity of personal W.P.(C) 6673/2021 Page 5 of 18 hearing, the respondent has caused any prejudice to the rights of the petitioner, and same does not vitiate the principles of natural justice.

The respondent further added that the impugned order also notes that several representatives of the petitioner appeared with a request of dropping of the proceedings and the same is being considered as a personal hearing.

It is further contended that the Adjudicating Authority rightly recorded that the telephonic conversation with the proprietor of the petitioner was equivalent to a personal hearing and any further personal hearings would amount to dilatory tactics on the part of the petitioner.

He further submits that the circular dated 10.03.2017 is not binding.

Observations & Judgement of the court

Visit of representatives is not equal to personal hearing

We fail to understand the reason for the Adjudicating Officer to observe that the visit of the representatives of the petitioners in the office of the Officer and the telephonic conversation the Officer had with the proprietor of the petitioner, could be termed as equivalent to personal hearing. It is not the respondent’s case that hearings were conducted in a virtual mode and, therefore, the personal hearing was granted over the telephone.

Telephonic conversation can’t be a substitution for personal hearing-

Moreover, the telephonic conversations for a brief period cannot, in our opinion, be a substitute for a personal hearing or for that matter, be construed as a hearing at all. The opportunity of hearing, which the Officer is statutorily required to give to the person against whom an adverse decision is contemplated, is not an empty formality, and is a well-recognised principle of audi alteram partem, which has rightly been incorporated in Section 75(3) and 75(4) of the CGST Act.

The officer was reprimanded and a cost of Rs. 5000 was levied on officer.

The respondent in utter disregard to the judicial time and to the statement made before the Court as well as before the learned Registrar then decided to contest the present writ petition without filing any affidavit of the concerned officer.

These kind of practices cannot be countenanced. The same has the effect of not only causing harassment to the litigants but also wasting the precious judicial time of the Court. This Court, therefore, considers it apposite to impose a cost of ₹5,000/- on the respondent.

The cost is directed to be deposited with the Delhi State Legal Services Authority within a period of four weeks.

The order be also sent to the Commissioner of GST, Department of Trade and Taxes, Vyapar Bhawan, IP Estate, New Delhi for necessary information and compliance and if it is found that there is dereliction of duties on the part of the concerned officer, appropriate action for recovery of the amount from the salary of the officer be taken.

Read & Download the Full Jupiter Exports v. Commissioner of GST

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.