Detention of goods for wrong classification (Pdf Attach )

Table of Contents

Cases Covered:

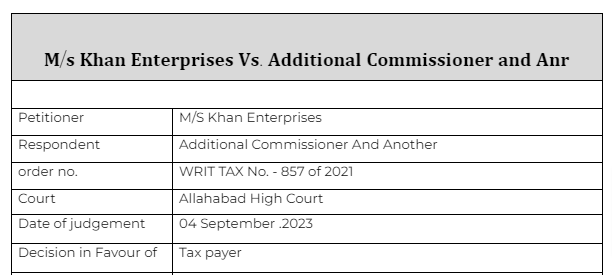

M/S Khan Enterprises Vs Additional Commissioner And Another

Citations:

- Anandeshwar Traders vs. State of U.P.

- Mohinder Singh Gill and another vs. The Chief Election Commissioner,New Delhi and others

- M/s Riya Traders vs. State of U.P. And another

- M/s Margo Brush India and others vs. State of U.P. And others

- M/s Gobind Tobacco Manufacturing Co. And another vs. State of U.P. And others

- S.K. Trading Co. And another vs.Additional Commissioner Grade 2 (Appeal) and another

- F.S. Enterprise vs. State of Gujarat

- M/s Sleevco Trader vs. Additional Commissioner Grade-2 (Appeal)

Facts of the case

The petitioner engaged in the transportation of Areca Nuts from Gurgaon to Robertsganj, Uttar Pradesh. During this transit, the consignment encountered an interception, leading to the recording of the driver’s statement in GST-MOV-01. Subsequently, an inspection of the goods was conducted, resulting in the issuance of GST-MOV-06, which ordered the detention of the goods. Complicating matters further, a supplementary notice was issued under Section 129(3) of the relevant act, asserting that the product being transported was not Areca Nut or Betul Nut but rather processed Betul Nut. In response to this, an Order of demand for tax and/or penalty under GST-MOV-09 was issued, compelling the petitioner to deposit an amount of Rs. 70,09,200/-. The petitioner lodged an appeal against this order, but regrettably, it was subsequently dismissed.

The petitioner contended that all necessary documents were presented with the goods, and no prima facie discrepancies were identified during the interception. Under Rule 112 of the GST Rules, the Department should not be allowed to introduce additional evidence at the appellate stage. Any subsequent statement by the driver, after the recording of GST-MOV-01, should be deemed inadmissible. Moreover, both parties were registered dealers during the transaction, which, according to the petitioner, meant that penalties could not be enhanced, and an order should have been issued under Section 129(1)(a) of the Act. The petitioner further argued that there was no provision cited that authorized the issuance of a supplementary notice, which presented a different product classification, despite physical verification aligning with the documents.

Observations & Judgement of the court

The court held that once the driver’s statement had been recorded in GST-MOV-01, any subsequent statements were impermissible in the absence of compelling evidence demonstrating perverse action against the petitioner. Additionally, the court noted the absence of any material indicating that the transported goods differed from those documented, as no expert opinion or laboratory examination was conducted, and physical verification yielded no discrepancies. The court reaffirmed the principles established in Anandeshwar Traders vs. State of U.P., stating that the State Department could not introduce additional evidence at the appellate stage.

Regarding penalties, the court emphasized that Section 129(1)(a) of the GST Act allowed for a penalty of 200% of the tax payable, but in this case, the imposed penalty was 200% of the value of the goods, which was deemed unsustainable. Consequently, the court set aside the orders against the petitioner and directed the refund of any deposited amount to the petitioner.

Read & Download the Full M/S Khan Enterprises Vs Additional Commissioner And Another

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.