Deptt cant reverse ITC ignoring the fact that form was not available on the Portal (Pdf Attach)

Table of Contents

Cases Covered:

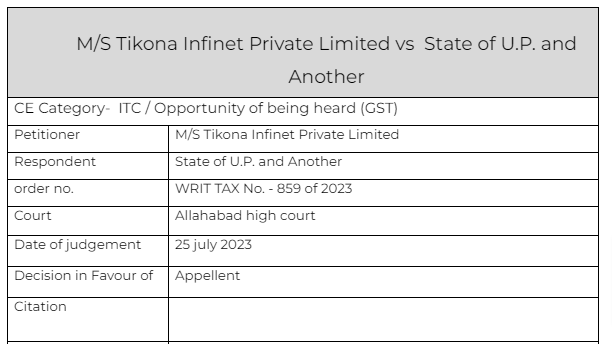

M/S Tikona Infinet Private Limited vs State of U.P. and Another

Facts of the case

The petitioner is a registered Company engaged in providing internet service across India from various State including the State of U.P. The petitioner entered into a Business Transfer Agreement on 17.08.2017 with another Company i.e. M/s Tikona Digital Network Pvt. Ltd. under which the business was transferred to the petitioner. M/s Tikona Digital Network (TDA) had accumulated ITS balance of more than Rs.3,1313,68,997/- which was unutilized.

ITC 02, the form for transfer of ITC was not available on the Portal.

Appellent took the ITC via GSTR 3b.But the department rejected this and raised an order for payment of ITC alongwith interest and penalty.

Observations & Judgement of the court

he honorable court decided that the stand of the Respondent No.2, for rejecting the claim of the petitioner in the wake of the admitted fact that the GST common portal was not online cannot be justified. We consequently set side the order dated 17.04.2023 with liberty to the Respondent No.2 to pass fresh order taking into consideration the objections of the petitioner and also affording it opportunity of hearing, strictly in accordance with law.

Read & Download the Full M/S Tikona Infinet Private Limited vs State of U.P. and Another

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.