High court give bail for ITC from a fake Supplier.

Table of Contents

Cases Covered:

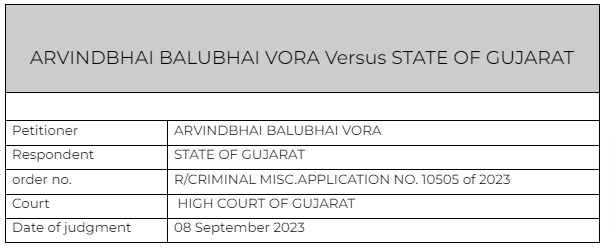

ARVINDBHAI BALUBHAI VORA

Versus

STATE OF GUJARAT

Citation:

Sanjay Chandra v. Central Bureau of Investigation

Facts of the Cases:

The petitioner engaged in the procurement of goods and duly claimed input tax credit. However, allegations surfaced regarding the legitimacy of the supplier’s registration, suggesting that it was fraudulently obtained through counterfeit documents. In response, the complainant initiated legal action by filing a First Information Report (FIR) for forgery, leading to the arrest of all the accused parties.

Observations & Judgement of the court:

The petitioner presented several key arguments:

(i) The petitioner, as a mere buyer, had no knowledge of whether the supplier’s registration was procured fraudulently. Furthermore, they maintained that they were entirely uninvolved in the alleged forgery.

(ii) It was asserted that the Goods and Services Tax (GST) Act is a self-contained legislative framework, with Section 29(2) clearly outlining the provisions for registration cancellation. Importantly, no formal notice had been issued to the petitioner regarding the cancellation of their registration or the reversal of any purported fake Input Tax Credit (ITC). Therefore, the petitioner contended that the police should not be leveling such allegations solely based on a private complaint.

(iii) The petitioner noted that co-accused individuals, who were allegedly involved in seeking forged registration, had already been released on bail, suggesting a lack of substantial evidence against them.

(iv) The petitioner emphasized that the ongoing investigation had not uncovered any actionable involvement on their part.

(v) Lastly, the petitioner pointed out that a charge sheet had already been filed in relation to the case, indicating that legal proceedings were progressing.

In summary, the petitioner’s arguments revolved around their status as a buyer, the procedural compliance with the GST Act, the lack of evidence against them, the bail granted to co-accused individuals, and the advancement of legal proceedings through the filing of a charge sheet.

Read & Download the Full ARVINDBHAI BALUBHAI VORA Versus STATE OF GUJARAT

[pdf_attachment file=”1″ name=”optional file name”]

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.