Cash cant be seized during search in GST (Pdf Attach)

Table of Contents

Cases Covered

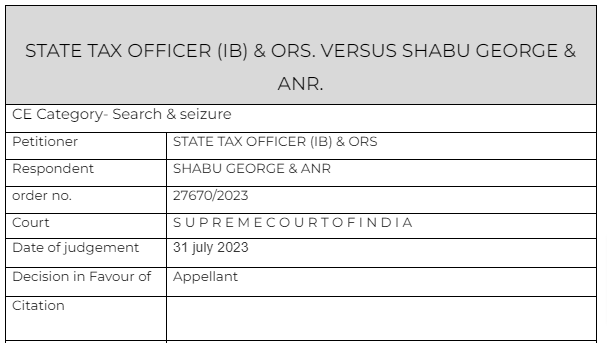

STATE TAX OFFICER (IB) & ORS. VERSUS SHABU GEORGE & ANR.

Facts of the cases :

The writ is filed for the release of the cash that was seized from his premises in connection with an investigation done by the authorities under the GST Act. The learned single Judge did not accept the contention of the appellant that the seizure of cash was unwarranted especially when the investigation itself was for alleged evasion of tax due from the appellants under the GST Act.

Observations & Judgement of the court :

The seizure of cash was held incorrect by the court and the officer was asked to return it.

” The aforesaid findings of the Intelligence Officer could perhaps have been justified had he been an officer attached to the Income Tax department. In the context of the GST Act, the findings are wholly irrelevant. We find that the seizure of cash from the premises of the appellants was wholly uncalled for and unwarranted. Moreover, as the respondent has retained the seized cash for more than six months and is yet to issue a show cause notice to the appellants in connection with the investigation, there can be no justification for a continued retention of the said amount with the respondent.”

Read & Download the Full STATE TAX OFFICER (IB) & ORS. VERSUS SHABU GEORGE & ANR.

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.