Detention memo should be a speaking order (Pdf Attach)

Table of Contents

Case Covered:

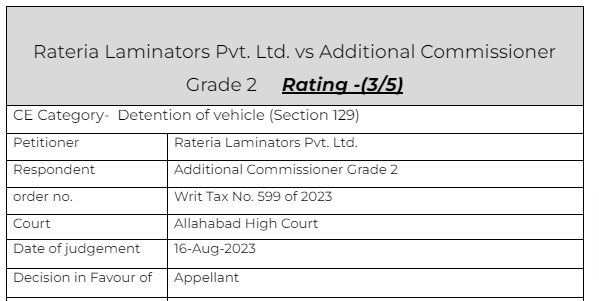

Rateria Laminators Pvt. Ltd. vs Additional Commissioner Grade 2

Citation:

1. Bharti Airtel Ltd. vs. State of U.P.

2. Assistant Commissioner (ST) vs. Satyam Shivam Papers Pvt. Ltd.

3. Gobind Tobacco Manufacturing Co. vs. State of U.P

Facts of the case

Petitioner in its normal course of business made inward supply of B55HM0003NA G-LEX HDPE-2 HSN 3901.20.00 15 from GAIL, Auraiya U.P. The petitioner also made inward supply of similar items from GAIL Auraiya U.P. for which two invoices dated 6.3.2023 were prepared, copies of which have been annexed as Annexure 2 to the writ petition.

It raised the invoice and made the E-way bill. But according to the appellant the driver fell ill and the truck had a breakdown. The time of the E-way bill lapsed and the vehicle was detained by the authorities.

An appeal was filed by the appellant which was rejected.

Observations & Judgement of the court

The court allowed the writ and remanded the case back to authorities. The order made by them was not reasoned. Thus a time of 15 days was given to arrange the evidence and give a reasoned order.

Read & Download the Full Rateria Laminators Pvt. Ltd. vs Additional Commissioner Grade 2

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.