Cancellation of registration when returns were filed set aside by the court (Pdf Attach)

Table of Contents

Cases Covered:

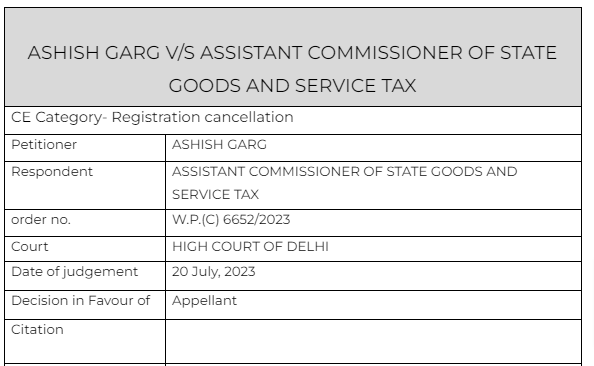

ASHISH GARG V/S ASSISTANT COMMISSIONER OF STATE GOODS AND SERVICE TAX

Facts of the cases:

It is the petitioner’s case that the respondent took no immediate steps to process the said application and the same remained pending for a considerable time. On 23.03.2020, the respondents issued a notice seeking additional documents for processing the petitioner’s application filed on 20.07.2019, for cancellation of his GST registration. Thereafter, the concerned officer passed an order rejecting the petitioner’s application for cancellation of his GST registration.

Another application was also dealt in a similar manner: the respondent did not act on the same for almost nine months and, thereafter on 24.03.2021, issued another notice seeking additional information from the petitioner.

Observations & Judgement of the court:

The appeal was granted with following reasons-

- In the present case, there is no material on record to justify such retrospective cancellation of GST registration by the Adjudicating Authority.

- There is no dispute that the petitioner had regularly filed his returns till 30.06.2019. Although in terms of Section 29 of the Central Goods and Services Tax Act, 2017, the concerned authority has the discretion to cancel the registration from a retrospective date, however, the said power cannot be exercised arbitrarily.

- The fact that the petitioner had not filed the returns for a continuous period of six months – the ground on which cancellation was proposed in terms of the Show Cause Notice dated 30.06.2021 – does not, in any manner, justify retrospective cancellation from the date that the registration was granted.

- As noticed above, it is the petitioner’s case that he had ceased carrying on his business from June, 2019. Clearly, in view of the said stand, the petitioner cannot be asked to file returns for the period after he had closed down his business.

Read & Download the Full ASHISH GARG V/S ASSISTANT COMMISSIONER OF STATE GOODS AND SERVICE TAX

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.