Detention order set aside by the court (Pdf Attach)

Table of Contents

Cases Covered:

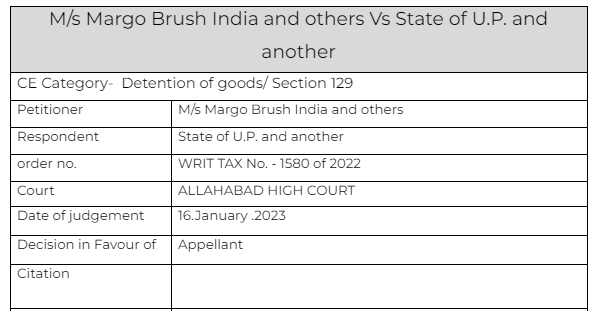

M/s Margo Brush India and others Vs State of U.P. and another

Facts of the cases:

It is a case in which the goods in transit were accompanied by proper documents. When show cause notice was issued to the driver of the vehicle, the petitioners had filed their replies. In terms of the provisions of Section 129(1)(a) of the Act, in case, the owner of the goods comes forward, the penalty is to be levied upon him. The penalty can be levied under section 129(1)(b) of the Act, only if the owner of the goods does not come forward. In the case in hand, vide impugned order the penalty has been levied under Section 129(1)(b) of the Act, which is not applicable.

Observations & Judgement of the court:

Circular dated December 31, 2018 issued by the Central Board of Indirect Taxes and Customs (hereinafter referred to as ‘Board’), whereby a clarification has been issued as to who is to be treated as owner of the goods for the purpose of Section 129(1) of the Act. It provides that if the goods are accompanied with invoices then consignor should be deemed to be the owner. In the case in hand, the petitioner nos. 1 and 2 are the consignors, whereas petitioner nos. 3 to 5 are consignees, hence, in their presence and accepting the ownership of the goods, the impugned order should not have been passed under Section 129(1)(b) of the Act.

The court allowed the petition and set assigned the impugned order.

Read & Download the Full M/s Margo Brush India and others Vs State of U.P. and another

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.