Bail granted on conditions by High court(Pdf Attach)

Table of Contents

Cases Covered:

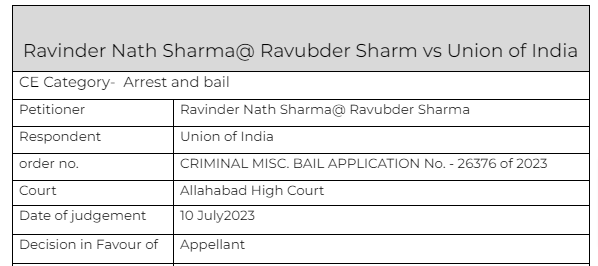

Ravinder Nath Sharma@ Ravubder Sharm vs Union of India

Facts of the cases:

Learned counsel for the applicant submits that the applicant is innocent and has been falsely implicated in the present case. It is further submitted that the applicant has been arrested without assigning any reason to believe nor any satisfaction to justified his arrest as provided in the Code. It is further submitted that offences as alleged are punishable up-to 5 years imprisonment. It is further submitted that no notice for recovery of G.S.T. has been issued against the applicant and he is illegally arrested. It is further submitted that till date penalty or taxes has not been ascertained as per Act. It is further submitted that the offences are compoundable in nature and triable by Magistrate. The applicant has been languishing in jail since 09.02.2023.

Observations & Judgement of the court:

He was granted bail on the following conditions-

(i) The applicant shall not directly or indirectly make any inducement, threat, or promise to any person acquainted with the facts of the case so as to dissuade him from disclosing such facts to the court or to any police officer or tamper with the evidence.

(ii) The applicant shall not pressurize/intimidate the prosecution witnesses.

(iii) The applicant shall remain present, in person, before the trial court on the dates fixed for (i) opening of the case, (ii) framing of charge and (iii) recording of statement under Section 313 of Cr.P.C.

(iv) The applicant shall file an undertaking to the effect that he shall not seek any adjournment on the dates fixed for evidence when the witnesses are present in the trial court.

(v) The applicant shall remain present before the trial court on each date fixed, either personally or through his counsel.

(vi) The applicant shall not indulge in any criminal activity or commission of any crime after being released on bail.

Read & Download the Full Ravinder Nath Sharma@ Ravubder Sharm vs Union of India

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.