ITC cant be denied for non appearance in GSTR 2A (Breaking) (Pdf Attach)

The GSTR 2A was introduced in GST in 2018. Many taxpayers had the confusion whether they can take the ITC if not appearing in GSTR 2A. At that time a clarification was given by the department that it is only to facilitate. Lateron rule 36(IV) was inserted and many things changed. Department started refusing the ITC for not appearing in GSTR 2A even if it belonged to pre rule 36(IV) period.

I think this judgement will be quite helpful for all those taxpayers suffering from these kind of demands.

Table of Contents

Cases covered:

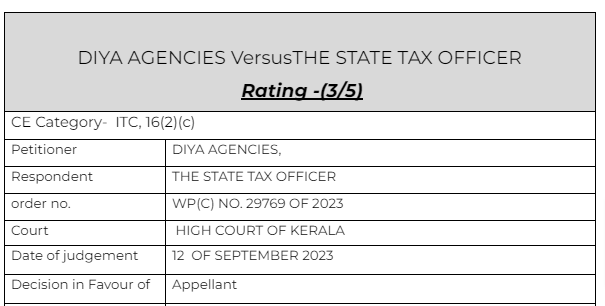

DIYA AGENCIES Versus THE STATE TAX OFFICER

Citations:

1. The State of Karnataka v. M/s. Ecom Gill Coffee Trading Private Limited

2. Suncraft Energy Private Limited and Another v. The Assistant Commissioner, State Tax, Ballygunge Charge and others

3. Union of India (UOI) v. Bharti Airtel Ltd. And Others

Facts of the cases:

The petitioner’s claim for the input tax credit of Rs.44,51,943.08/- for CGST and SGST has been limited at excess claim of Rs.1,04,376.05/- as CGST and same amount as SGST credit has been denied on the ground that as per the GSTR 2A in respect of invoice supply, the tax payer is only eligible for input tax amount shown in CGSTR 2A.

Thus the writ is filed by the petitioner to get that order quashed.

Observations & Judgement of the court:

I find that the impugned Exhibit P-1 assessment order so far denial of the input tax credit to the petitioner is not sustainable, and the matter is remanded back to the Assessing Officer to give opportunity to the petitioner for his claim for input tax credit. If on examination of the evidence submitted by the petitioner, the assessing officer is satisfied that the claim is bonafide and genuine, the petitioner should be given input tax credit.

Merely on the ground that in Form GSTR-2A the said tax is not reflected should not be a sufficient ground to deny the assessee the claim of the input tax credit.

Read & Download the Full M/S DIYA AGENCIES Versus THE STATE TAX OFFICER

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.