Cancellation of registration order should be reasoned(Pdf Attach)

Table of Contents

Cases covered:

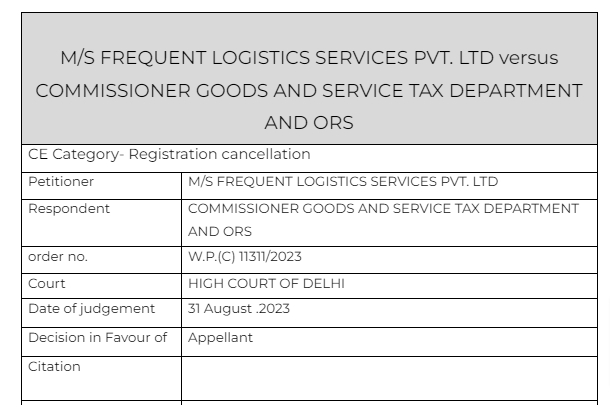

M/S FREQUENT LOGISTICS SERVICES PVT. LTD versus COMMISSIONER GOODS AND SERVICE TAX DEPARTMENT AND ORS

Facts of the cases:

A SCN was sent to the appellant for cancellation of their registration. The appellant didn’t appear for the hearing. Thus an order for the cancellation of registration wa spassed by the department with following

“1. Reply not receive. Hence, the registration Suo Moto cancelled.”

The taxpayer approached the court for restoration of registration

Observations & Judgement of the court:

The court rejected the cancellation order.

The present petition is allowed solely on the ground that the Show Cause Notice falls short on the standards required of a Show Cause Notice. At the least, the Show Cause Notice must clearly indicate the reasons for which an adverse order is proposed to be passed in order for the noticee to respond to the same

Read & Download the Full M/S FREQUENT LOGISTICS SERVICES PVT. LTD versus COMMISSIONER GOODS AND SERVICE TAX DEPARTMENT AND ORS

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.