Adjournments should be given in case of genuine problem of Applicant(Pdf Attach)

Table of Contents

Cases covered:

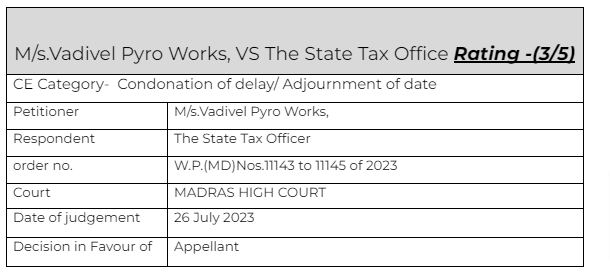

M/s.Vadivel Pyro Works, VS The State Tax Officer

Citations:

Pinstar Automotive India Private Limited Vs. Additional Commissioner

Facts of the cases:

The audit of petitioner was conducted by the deptt. After that a notice was sent to the applicant. He asked for the adjournment. For the next two dates also he was asking for the adjournment.

On 10.11.2022 at about 09.19 AM, the petitioner has submitted an adjournment letter and the respondent has received the same. But on the same date, i.e., on 10.11.2022 by 01.22 PM, the respondent has passed the assessment order without considering the adjournment letter presented by the petitioner. The respondent submitted that since the petitioner was granted three opportunities, as per Section 73, the respondent is not empowered to grant further adjournment, therefore, the respondent did not consider the adjournment letter and proceeded to pass the assessment order.

On perusal of the assessment order, it is seen that the respondent has not recorded the said adjournment letter at all.

Observations & Judgement of the court:

Petitioner should be provided one more opportunity.

It is seen the petitioner filed a rectification petition under Section 161. Before filing the rectification petition, the petitioner collected all the records and filed the rectification petition along with the records. This would indicate that the petitioner was bonafide in seeking time to furnish all the records. If the petitioner has filed the rectification petition without any records, the claim of the respondent ought to be accepted, but in the present case it is for the genuine reason the petitioner has sought for adjournment

Read & Download the Full M/s.Vadivel Pyro Works, VS The State Tax Officer

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.