SC upheld the requirement of Pre deposit for filing an appeal in Tribunal(Pdf Attach)

Table of Contents

Cases Covered:

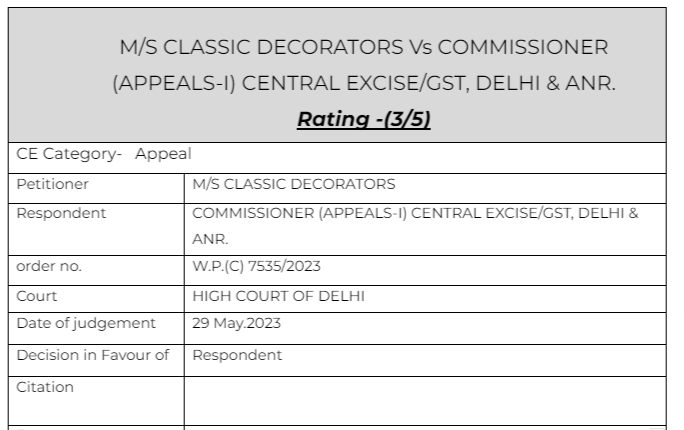

M/S CLASSIC DECORATORS Vs COMMISSIONER (APPEALS-I) CENTRAL EXCISE/GST, DELHI & ANR

Facts of the Cases:

In this case the petitioner appealed to waive off the requirement of pre deposit for filing an appeal.

1. The petitioner has filed the present petition, inter alia, praying as under: – “1. To cancel the order dated 04-05-2023 passed by respondent no.1. 2. To direct the respondent no.1 to decide the appeal on merit without insisting for pre deposit as per section 35F of the Central excise Act, 1944.”

Observations & Judgement of the High court:

The court observed that there is no such requirement. The court said that the amount of pre deposit is a meager sum and the appellant can deposit it.

“6. We find no merit in the aforesaid contention. The amount of pre-deposit required is 7.5% of the total demand, which is not a large sum. There is no averment that the requirement of pre-deposit has rendered the appellate remedy illusory or that the petitioner is any way impeded from availing the same.

Observations & Judgement of the supreme court:

Later on the appeal in SC was rejected and the decision of the high court was upheld.

Read & Download the Full M/S CLASSIC DECORATORS Vs COMMISSIONER (APPEALS-I) CENTRAL EXCISE/GST, DELHI & ANR

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.