Section 3 : Officers under this Act. ( Updated till July 2024 )

Table of Contents

Section 3 of the CGST Act as amended by the Finance Act 2023

Note: Section 3 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is depicted with a different color.

Text On Section:

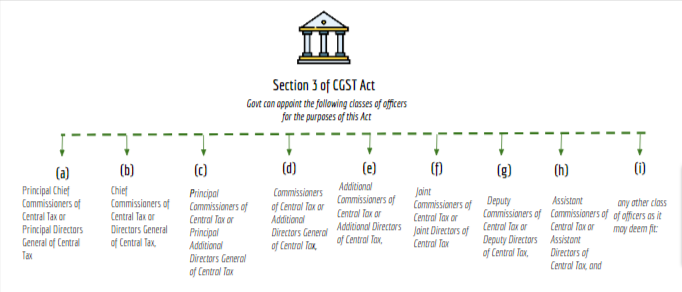

The Government shall, by notification, appoint the following classes of officers for the purposes of this Act, namely:-

(a) Principal Chief Commissioners of Central Tax or Principal Directors General of Central Tax,

(b) Chief Commissioners of Central Tax or Directors General of Central Tax,

(c) Principal Commissioners of Central Tax or Principal Additional Directors General of Central Tax,

(d) Commissioners of Central Tax or Additional Directors General of Central Tax,

(e) Additional Commissioners of Central Tax or Additional Directors of Central Tax,

(f) Joint Commissioners of Central Tax or Joint Directors of Central Tax,

(g) Deputy Commissioners of Central Tax or Deputy Directors of Central Tax,

(h) Assistant Commissioners of Central Tax or Assistant Directors of Central Tax, and

(i) any other class of officers as it may deem fit:

Provided that the officers appointed under the Central Excise Act, 1944 (1 of 1944) shall

be deemed to be the officers appointed under the provisions of this Act.

Chart of the Section :

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.