Upload of order on GSTN portal is not equal to communication (Writ accepted) stay given with 50% tax deposit

The author can be reached at shaifaly.ca@gmail.com

Table of Contents

Cases Covered:

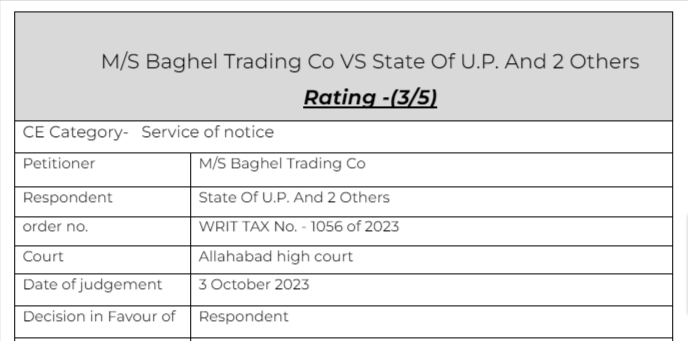

M/S Baghel Trading Co VS State Of U.P. And 2 Others

Citations:

- Whirlpool Corporation vs. Registrar of Trademarks

- Mr.Chandar Jain vs. U.O.I. Through Secretary,

- Om Prakash Mishra vs. State of U.P. And others

Facts of the cases:

The petitioner submits that the impugned order was neither communicated, nor served upon the petitioner. She further submits that the respondent no. 2 has failed to appreciate the word “communicated” used in section 107 of the GST Act in contrast to the word “served” used in section 169 of the GST Act. Therefore, the order dated 23.10.2021 may have been served by making it available on the portal as provided under section 169 of the GST Act, but the same will not amount to communication of the order as the order can be said to be communicated only when the person concerned comes to know about the same.

He further submits that sub-section (1) of section 169 of the GST Act provides the mode of services, i.e., by registered post or speed post, communication on e-mail, making available on the common portal, by publication in newspaper or by affixation. However, as per sub-section (2) of section 169 of the GST Act, the order is deemed to be served only in case the service is effected by tendering or published or a copy thereof is affixed in the manner as provided in sub-section (1).

Observation & Judgement of the Court:

Learned counsel for the respondents may file counter affidavit within a period of four weeks from today. In the counter affidavit, the State shall specifically averred as to how and under what manner, the deeming service as per clauses (c) & (d) of sub-section (1) of section 169 can be said to be deemed service as per sub-section (2) of section 169 of the GST Act. List thereafter along with Writ Tax No. 948/2023. In the meantime, no coercive action shall be taken against the petitioner pursuant to the impugned order, provided the petitioner deposits 50% of the disputed tax amount in accordance with law within a period of two weeks from today

Comment:

The case was listed for two weeks later. An amount of 50% of disputed tax was required to be paid by the taxpayer and stay from any other proceedings was granted by the honorable court.

Read & Download the Full M/s. Baghel Trading Co VS State Of U.P. And 2 Others

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.