Bail granted to Chartered Accountant in PMLA Case

The author can be reached at shaifaly.ca@gmail.com

Table of Contents

Cases Covered:

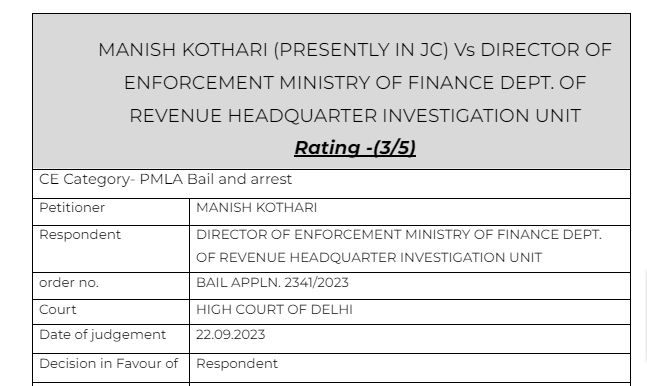

MANISH KOTHARI Vs DIRECTOR OF ENFORCEMENT MINISTRY OF FINANCE DEPT. OF REVENUE HEADQUARTER INVESTIGATION UNIT

Citations:

Sanjay Pandey v. Directorate of Enforcement2022 SCC

Ranjit Singh Brahamjeet Singh Sharma v. State of Maharastra

Mohd. Muslim Hussain vs. State (NCT of Delhi)

Facts of the cases:

The petitioner is aggrieved of the order dated 09.06.2023 whereby the bail application of the petitioner has been dismissed by the learned Special Judge primarily on the ground that the petitioner has failed to meet the threshold of Section 45 of PMLA. Learned trial court has inter alia held that the petitioner has actively assisted the co-accused to convert the tainted money into untainted money and connived in the laundering thereto.

Observation & Judgement of the Court:

It is an admitted case that the petitioner herein was a chartered accountant of Anubrata Mondal. The case of the ED is that the present petitioner was instrumental in projecting the tainted money as untainted money. The apparent role of the petitioner is the filing of the income tax return. It is a settled proposition that at the stage of consideration of the bail even under PMLA, the court has only to see the preponderance of probability. The court at this stage is not required to record the positive finding of acquittal. Such findings can be recorded only after recording and appreciation of the evidence by the learned trial court. The case of the petitioner that Anubrata Mondal is shifting his blame on the petitioner only to save himself has to be tested during the course of the trial. Generally speaking, the professional would act on the instructions of his client. However, whether he has gone beyond his professional duty is something that is required to be seen and examined during the trial. The allegation against the present petitioner is not that he has done something that was beyond his scope of profession i.e. indulging in some activities which are totally unconnected with the chartered accountancy. The plea of the petitioner that he has acted on the basis of information and records provided to him cannot be rejected outright at this stage. This is required to be tested during the trial. 26. Any further appreciation of the evidence at this stage may prejudice the case and therefore is not expected. It has repeatedly been held that the bail stage cannot convert into a mini-trial. It is also pertinent to mention here that the court has only to take a prima facie view on the basis of the material on record.

comment:

The court provided the bail to the CA because there is no evidence that he has acted out of the scope of his professional duties

Read & Download the Full MANISH KOTHARI Vs DIRECTOR OF ENFORCEMENT MINISTRY OF FINANCE DEPT. OF REVENUE HEADQUARTER INVESTIGATION UNIT

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.