The notice is returned as unclaimed, it shall be deemed to be served

The author can be reached at shaifaly.ca@gmail.com

Table of Contents

Cases Covered:

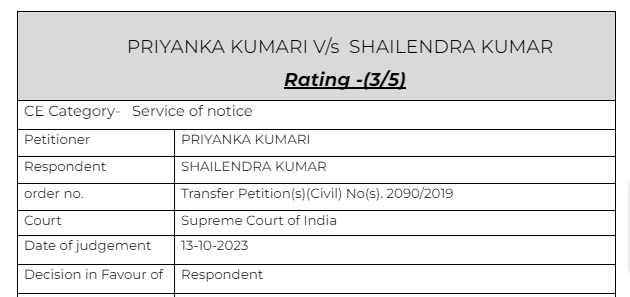

PRIYANKA KUMARI V/s SHAILENDRA KUMAR

Citations:

K.Bhaskaran Vs. Sankaran Vaidhyan Balan and Another,

Ajeet Seeds Limited Vs. K. Gopala Krishnaiah

Facts of the cases:

A notice was sent to the petitioner. But it was not received and was returned as “Unclaimed”. Whether it will be deemed to be delivered?

Observation & Judgement of the Court:

As held by the Hon’ble Supreme Court in the above decisions, when a notice is served to the proper address of the addressee, it shall be deemed to be served unless the contrary is proved. Thus, when the notice is returned as unclaimed, it shall be deemed to be served and it is proper service. Therefore, service of notice to the sole respondent which has returned as unclaimed is considered as deemed to be served but none has entered an appearance.

Read & Download the Full PRIYANKA KUMARI V/s SHAILENDRA KUMAR

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.