Benefit of amnesty should be provided even if after or before the period given in scheme

The author can be reached at shaifaly.ca@gmail.com

Table of Contents

Cases Covered:

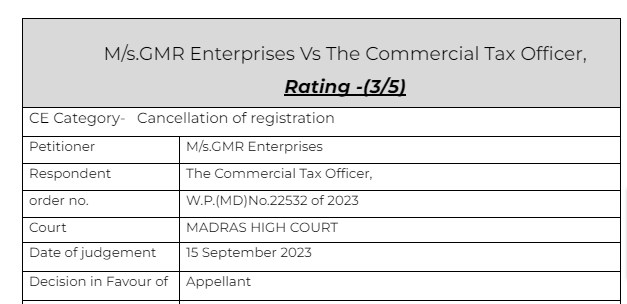

M/s.GMR Enterprises Vs The Commercial Tax Officer,

Citations:

Tvl.Suguna Cut piece Vs Appellate Deputy Commissioner

Facts of the cases:

A writ was filed to quash the cancellation of registration.

This writ petition is filed for writ of Certiorarified Mandamus, to quash the cancellation order in Reference Number:ZA330523054106Y, dated 11.05.2023 and also seeking further direction to the respondent to revoke the cancellation of Registration under the GST Act bearing GSTIN/UIN: 33AOHPM2353K2ZW. within such time as may be directed by this Court

Observation & Judgement of the Court:

After hearing the rival submissions, this Court has given its anxious consideration. It is seen from the records that the government has issued Notification No.03/2023~Central Tax dated 31.03.2023 and has extended the time up to 30.06.2023, but the extension is granted to taxpayers granting time on or before 31.12.2022. Unfortunately, the petitioner’s cancellation was on 11.05.2023,had it been prior to 31.12.2022 then the petitioner would have come within the time prescribed under the said notification. But the consideration for extension was pending during that period, hence this Court is of the considered that the petitioner is entitled to the benefit. Moreover, the issue is covered under the judgment of Tvl. Suguna Cut Piece’s case as stated supra.

Read & Download the Full M/s.GMR Enterprises Vs The Commercial Tax Officer,

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.