The ITC was allowed even if the by-product is not taxable. It was a judgment of VAT but is applicable on GST also.

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

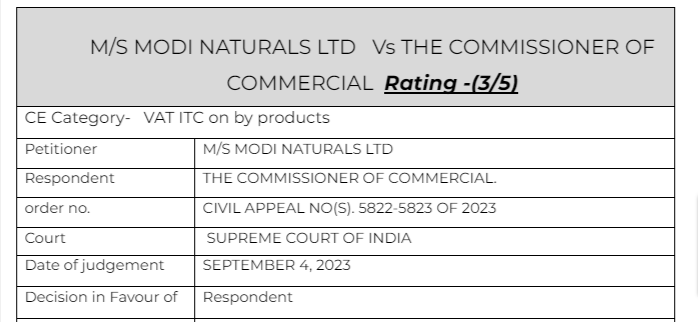

M/S MODI NATURALS LTD Vs THE COMMISSIONER OF COMMERCIAL

Citation

State of Karnataka v. M.K. Agro Tech Private Limited,.

Partington v. Attorney General

Rajasthan Rajya Sahakari Spg. & Ginning Mills Federation Ltd. v. CIT

State Bank of Travancore v. CIT

Cape Brandy Syndicate v. IRC

CIT v. Kasturi and Sons Ltd

State of W.B. v. Kesoram Industries Ltd

Facts of the cases:

The assessee is a company engaged in the business of manufacture and sale of Rice Bran Oil (for short, ‘RBO’) and Physical Refined RBO. The assessee as stated above is a registered dealer under the UP VAT Act and the RBO manufactured by the assessee falls within the ambit of “taxable goods” under the UP VAT Act. For the purpose of manufacturing RBO, the assessee procures Rice Bran (for short, ‘inputs’/‘purchased goods’) and follows the Solvent Extraction Process. During the manufacturing process of RBO a byproduct in the form of “De-Oiled Rice Bran” (for short, ‘DORB’) is also produced. DORB falls within the category of exempted goods under S. No. 4 of Schedule – I of the UP VAT Act. On the basis of the statutory provisions of Section 13(1)(a) read with S. No. 2(ii) of the Table appended thereto and Section 13(3)(b) read with Explanation (iii) to Section 13 of the UP VAT Act, the assessee claimed full amount of tax paid as ITC i.e., a sum of Rs. 4,68,47,670/-. The claim of the assessee came to be rejected vide the Order of the Deputy Commissioner, Tax Fixation, Div. – I, Pilibhit passed in terms of Section 28(2)(i) of the UP VAT Act. It is the case of the revenue that had the assessee has been permitted to avail the full ITC, it would have led to a loss of Rs. 1,90,88,763.00 to the State exchequer.

Observation & Judgement of the Court:

However, the scheme under the UP VAT Act is not the same as in Karnataka and no such provision regarding calculation of the apportionment etc., has been provided for under the UP VAT Act. The reliance by the High Court therefore on this decision is not correct. It is not applicable to the facts of the present case, and could not have been relied upon to deny the full ITC to the assessee

The impugned common judgment and order passed by the High Court of Allahabad is hereby set aside and the orders passed by the Commercial Tax Tribunal dated 04.05.2016 and 05.07.2017 are hereby restored

Read & Download the Full M/S MODI NATURALS LTD Vs THE COMMISSIONER OF COMMERCIAL

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.