Once the registration is granted it can be cancelled only as per section 29(2)

The author can be reached at shaifaly.ca@gmail.com

Table of Contents

Cases Covered:

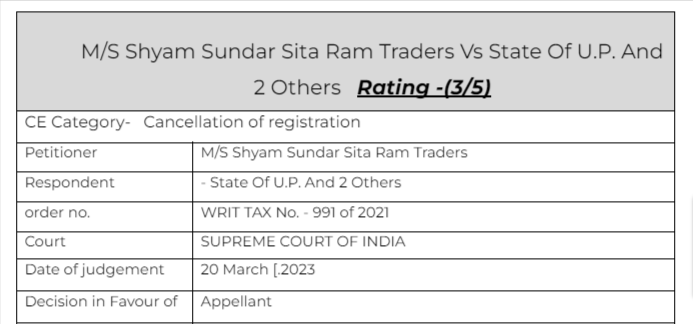

M/S Shyam Sundar Sita Ram Traders Vs State Of U.P. And 2 Others

citations:

TDRS Wood Products Lucknow vs State of U.P. and other

Marketing Private Limited vs State of U.P. and others

Facts of the cases:

The registration of the firm was cancelled vide order dated 31.03.2021 cancelling the registration on the ground that as per the information received, the firm was indulged in availing fake ITC credit from bogus firm. It was recorded that the reply given by the petitioner was not satisfactory as at the time of survey, no business activity was found at the given address. It was also recorded that the amendment as alleged was not given before the survey and was an afterthought.

Observation & Judgement of the Court:

Be that as it may, from the perusal of the order passed in appeal as well as the order cancelling the registration, it is apparent that the respondents have committed error while deciding the issue on the ground that several firms were availing wrong ITC credit and were essentially bogus firms. This Court in the case of Apparent Marketing Private Limited (Supra) has already dealt with the said issue and has recorded that once registration is granted, the same could be cancelled only in terms of the conditions prescribed under Section 29(2) and allegedly being a bogus firm is not a ground enumerated under Section 29(2). Thus following the said judgment and coupled with the fact that the respondents themselves have initiated proceedings against the firm under Section 74, the order rejecting the application for revocation was a wrong exercise of power by the department. The appellate order is equally bad, inasmuch as, no such ground was mentioned before passing the order of cancellation and, thus the impugned orders 17.05.2021 and 14.09.2021 are set aside.

comment;

The registration cant be cancel for any other reason than as per the provisions of section 29(2) of CGST Act

Read & Download the Full M/S Shyam Sundar Sita Ram Traders Vs State Of U.P. And 2 Others

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.