How a penalty in GST reduced from 56 lac to Rs. 10,000

GST penalty reduced from Rs. 56 lac to Rs. 10,000

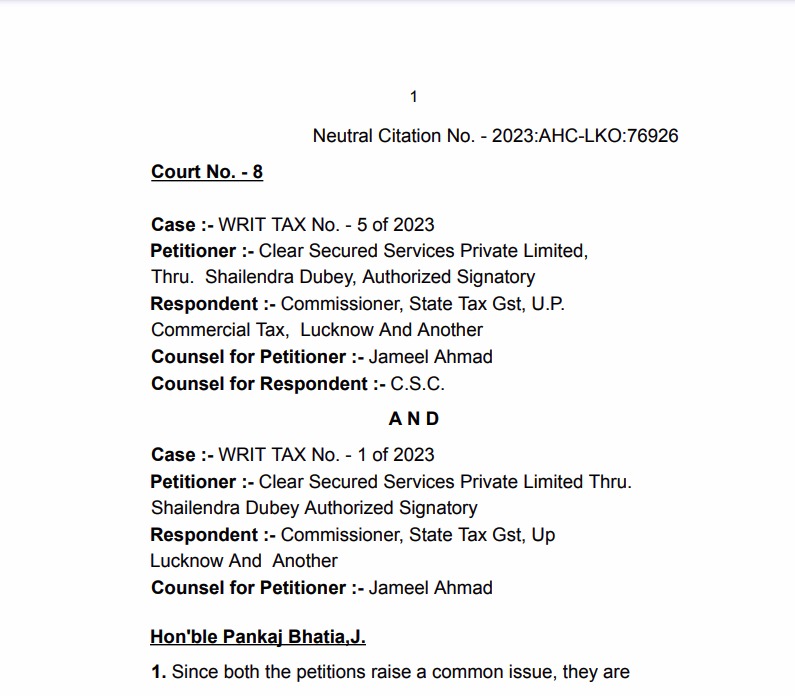

This is going to be an interesting read. In a judgement the court reduced the penalty of Rs. 56 lac (Approx) to Rs. 10,000. In this case the penalty u/s 122 was levied for not paying the amount of tax collected within a time period of 3 months. In many such cases this case will be useful as you will be able to get decisions based on it. (for any assistance the author can be reached at shaifaly.ca@gmail.com)

Section 122(1)(iii) of the Act reads as under:

“122: Penalty for certain offences.

(1) Where a taxable person who – …. (iii) collects any amount as tax but fails to pay the same to the Government beyond a period of three months from the date on which such payment becomes due.

Further Section 123 126, 127 & 128 of the Act, were also considered.

In this case the taxpayers couldn’t paid the tax due to the Pandemic. But the relief period given during the pandemic was over.

The court said that-

“In the facts of case, the maximum penalty imposable was Rs.10,000/- or the tax evaded, whichever was more; there being no allegation of tax evasion, the maximum penalty that could have been imposed was Rs.10,000/- which could even be lower than the said amount if the Taxing Authority as well as the Assessing Authority had considered the mandate of Section 126(2) of the Act read with Notification dated 01.06.2021. The said exercise clearly has not been done.”

Read and download the original judgment copy.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.