[Breaking-read order] Court allowed to edit the return where ITC was claimed in wrong head

Wrong ITC claimed

Very common scenario in the initial period of GST. The ITC of CGST SGST , wrongly claimed in IGST. Very useful judgment for all those taxpayer who committed the same mistake.

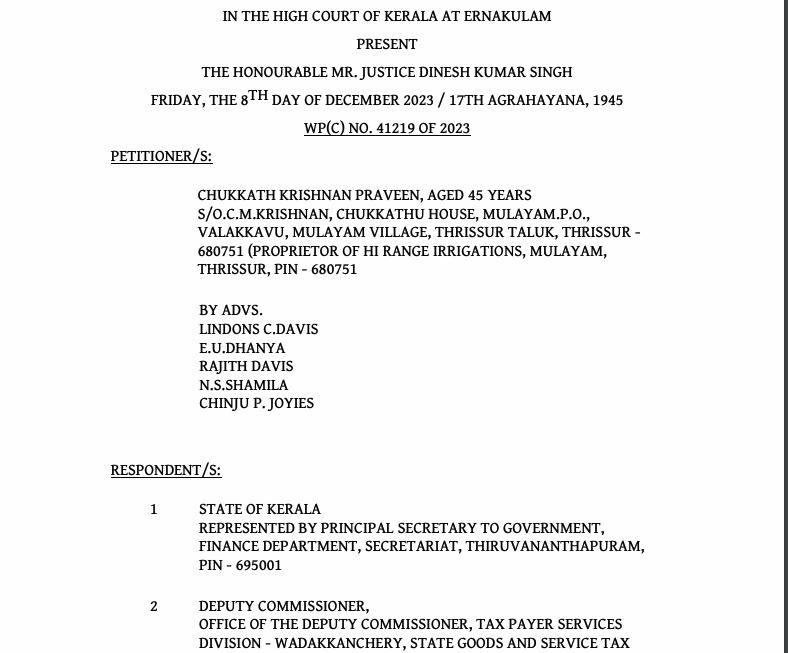

Here the court said that the Copy of the representation submitted and A copy of Goods and Service Tax -Tax liabilities and ITC Comparison alongwith details of bills as perGSTR 2A, Considered as rectification application by the court where ITC was claimed in wrong head- Chukkath Krishnan Vs State of Kerala.

In the words of honourable court-

“In view thereof, the present writ petition is disposed of with a direction to the 3rd respondent to consider Ext.P4 and Ext.P5 as a rectification application filed by the petitioner/assessee and pass necessary orders expeditiously in accordance with the law, after giving an opportunity of hearing to the petitioner. The order should be passed on Exts.P4 and P5, preferably within a period of two months.”

Read/ Download the judgment

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.