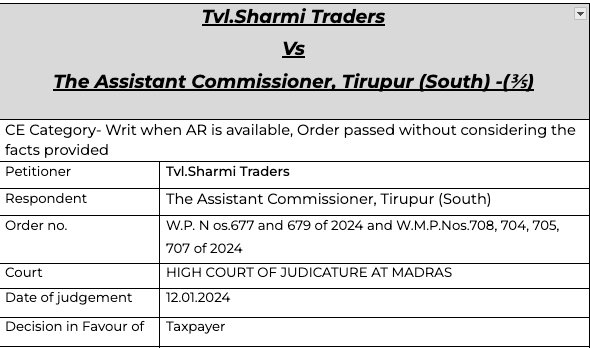

Order passed without considering the reply is quashed by HC

Table of Contents

Area covered by the judgment-

CE Category- Writ when AR is available, Order passed without considering the facts provided. The WRIT was accepted inspite of alternate remedy.

(The author can be reached at shaifaly.ca@gmail.com)

Pleading

PRAYER in W.P.No.677 of 2024: Writ Petition filed under Article 226 of the Constitution of India, pleased to issue a Writ of Certiorari, to quash the order under Section 74 of the GST Acts dated 03.07.2023 and the consequent Summary of the order in Form GST DRC-07 dated 03.07.2023 for the Financial Year (FY) 2020-21 both passed by the first respondent and both having Reference Number ZD330723004519J and the order dated 26.06.2023 in GSTIN 33BDVPS4709M1ZR / 2020-21 for the Financial Year (FY) 2020-21 passed by the second respondent.

Fact

On examining the impugned order in respect of Issue No.1 relating to wrong availment and utilization of ITC, the following was recorded in respect of thereof in the operative portion of the order: “Issue No.1 – Wrongly availed and utilized input tax credit:- The tax payer raised his objections against this discrepancy noticed by stating that they had stated that they had actually purchased the goods from their suppliers and to drop the proposals. They have not submitted any records related to the movement of goods from the supplier’s place to their business premises, mode of transport and records related to the physical movement of goods.

In the absence of valid supportive documents for the physical movement of goods the objections and records submitted is not supportive to their objections and hence the proposals for the levy of tax, penalty and interest are found to be in order and hence the proposals are confirmed.”

Observation

The impugned order does not contain any discussion on the documents produced by the petitioner to corroborate the assertion that legitimate purchases were made and point out deficiencies or inadequacies. On that ground, the impugned order calls for interference. Therefore, the impugned orders dated 03.07.2023 are quashed. As a corollary, these matters are remanded for re-consideration. The second respondent is directed to re-consider the matter and issue a fresh assessment order after providing a reasonable opportunity to the petitioner.

The petitioner has placed on record invoices and E-way bills relating to the relevant purchases. The E-way bills contain details of not only the products purchased by the petitioner but also the vehicles used for the movement of goods. The impugned order does not contain any discussion on the documents produced by the petitioner to corroborate the assertion that legitimate purchases were made and point out deficiencies or inadequacies.

Read and download the copy of judgment-

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.