Time limit u/s 62(2) is not mandatory- TP have right to file return- HC

Table of Contents

The time limit of section 62(2)-

In case of best judgment assessment, the proceedings are dropped if the TP files the return within 30 days. But if they file it after 30 days. Should it be allowed ? See what court said?

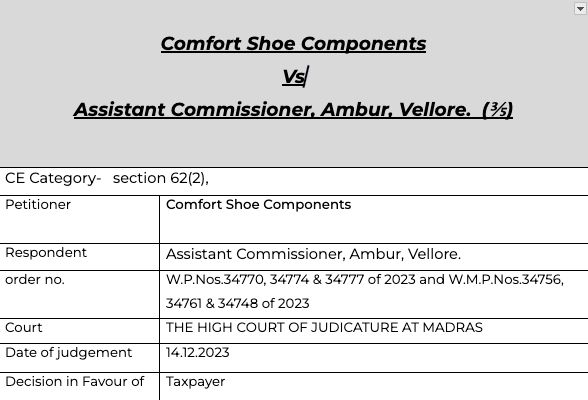

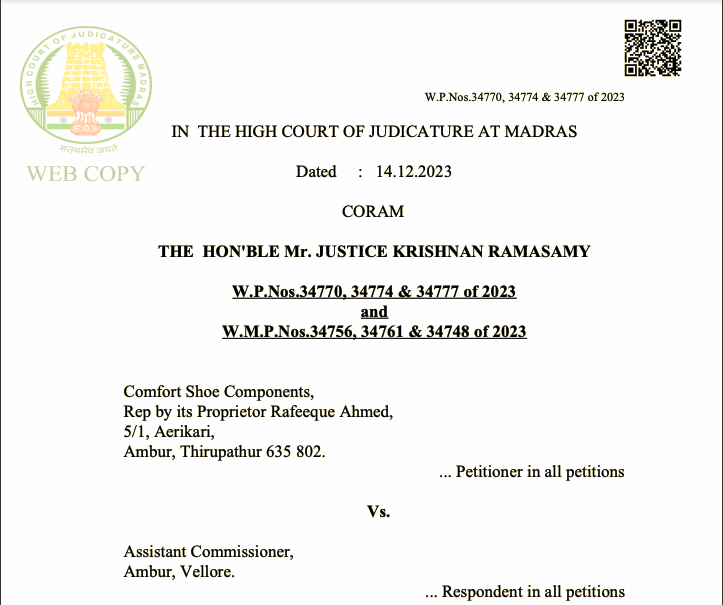

In case of Comfort shoe components Vs Assistant Commissioner , Ambur, Vellore

Pleading

Writ Petition filed under Article 226 of the Constitution of India praying to issue a Writ of Certiorari, to call for the records of the orders dated 28.03.2023 in Form GST ASMT-13 with Ref Nos.ZD330323137506O and ZD330323137686E respectively and also the order dated 10.04.2023 in Form GST ASMT-13 with Ref No.ZD330423037826F issued by the respondent and quash the same.

Fact

The learned counsel for the petitioner would submit that the petitioner was not able to file their returns for the month of December 2022, January 2023 and February 2023 within the prescribed time limit. Hence, the respondent had passed the impugned orders, which are the best judgement assessment orders, in terms of the provisions of Section 62(1) of the Goods and Services Tax Act, 2017 (hereinafter called as “GST Act”) on 28.03.2023 for the month of December, 2022 and January 2023 and on 10.04.2023 for the month of February 2023. Thereafter, the petitioner had taken steps and filed the returns for the month of December 2022 and January 2023 on 30.04.2023. Further, the petitioner had also filed the returns for the month of February 2023 on 24.06.2023.

In the present case, since the petitioner had not filed the returns for the months of December 2022, January 2023 and February 2023 within the prescribed time limit, the assessment order has been passed by the respondent under Section 62(1) of the GST Act on 28.03.2023 and 10.04.2023.

Observation

At any cost, the right to file the returns cannot be taken away stating that the petitioner has not filed any returns within a period of 30 days from the date of best judgement assessment order. Thus, if any application is filed before the Authority concerned with sufficient reasons for non-filing of returns within the prescribed time limit as per section 62(2) of the Act, the same shall be considered on merits. If the Authority is satisfied with the said reasons, they can condone the delay and permit the petitioner to file the returns. However, in the present case, no such application was filed by the petitioner. Therefore, this Court is inclined to pass the following orders:

(i) The petitioner is directed to file an application for condonning the delay in filing the returns within a period of 15 days from the date of receipt of copy of this order;

(ii) Upon filing of the application for condonnation of delay, the respondent is directed to consider the said application and pass orders by taking into consideration of the reasons provided by the petitioner for non-filing of returns within a period of 30 days from the service of best

judgement assessment order and thereafter, permit the petitioner to file the revised returns;

Comment

The time limit under section 62(2) is directory. If the return is filed even after that date, it will be considered and the proceedings will be dropped. The right to file returns can’t be taken from the taxpayer.

Read(Download) the copy of judgment-

Comfort_Shoe_Components_14_dec2023

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.