[Breaking]No Interest if the amount was deposited in cash ledger even if 3b isn’t filed

Table of Contents

When tax is deemed to be paid?

In this case the return was not filed by the taxpayer as he was facing difficulty in transitional credit.They were unable to file the July 2017 return. Now GST portal doesn’t allow you to filr the return if the 3b of last month is not filed. So every month they deposited the balance of due and ITC in their cash ledger. Now the department sent them a notice for interest.

They pleaded to quash the notice as they already deposited the tax. According to their request they ar not liable to pay the tax.

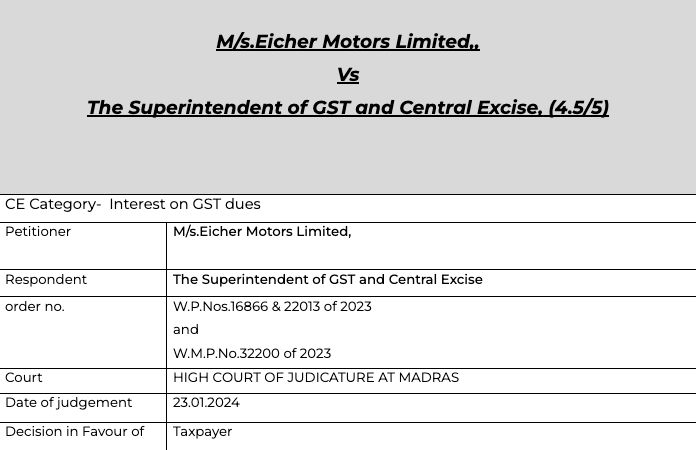

Case details-

Madras high court judgment on Interest

Citations –

(i) Refex Industries vs. Assistant Commissioner of CGST reported in 2020 SCC Online Mad 587;

(ii) Manasarover Motors P Ltd vs Assistant Commissioner reported in 2020 SCC Online Mad 28155;

(iii) Srinivasa Stampings vs. SPT of GST & CE in W.P.No.7129 of 2021

(iv) P.K.Ores P Ltd vs Commissioner of State Tax reported in MANU/OR/236/2022;

(v) Orissa Stvedores Ltd vs. Union of India reported in MANU/OR/1116/2022;

(vi) RSB Transmission (India) Ltd. vs. Union of India reported in MANU/JH/1260;

(vii) Haji Lal Mohd Biri Works vs. State of Uttar Pradesh reported in (1974) 3 SCC 137;

(viii) The Sales Tax Officer vs. Dwarika Prasad Sheo Karan Dass reported in (1977) 1 SCC 22;

(ix) Khazan Chand vs. State of Jammu and Kashmir reported in (1984) 2 SCC 456;

(x) Prahlad Rai vs. Sales Tax Officer reported in (1991) Supp (2) SCC 612;

(xi) Commissioner of Sales Tax vs. Qureshi Crucible reported in (1993) Supp (3) SCC 495;

Romesh Kumar Sharma – Apex court

Modipon Ltd

Megha Engineering and Infrastructures Limited vs. CCT

Vishnu Aroma Pouching Private Limited vs. Union of India reported in 2020 (38) G.S.T.L. 289 (Guj.),

Pleading

To drop the notice demanding the interest on the amount deposited in the electronic cash ledger where the return was not filed.

Facts

The petitioner is a renowned manufacturer of mid-sized motorcycles (250-750CC), vide HS Code 8711 led by the iconic brand Royal Enfield, with its manufacturing unit in Tamil Nadu. They have their Global Head Quarters in Chennai and three manufacturing facilities at Oragadam, Vallam and Tiruvottiyur. The petitioner is operating through their dealers and distributors and by means of more than 1000 large stores and 900 studio stores in major cities and also having more than 800 authorized dealers in India alone.

The petitioner has paid a sum of Rs.15,033 Crores as GST for the period from the year 2017-18 till the year 2023. Out of the said amount, a sum of Rs.10,871 Crores was paid using the Input Tax Credit and a sum of Rs.4,162 Crores was paid in cash

On the date of introduction of GST i.e., 01.07.2017, the petitioner had an accumulated balance of a sum of Rs.33,87,10,445/- as CENVAT credit ready to be transitioned into the GST regime. However, owing to want of system readiness and technical glitches in the GST Common Portal during the initial stages of implementation of GST, the Department had extended the due dates for filing the Form GST TRAN-1 from time to time and accordingly, the petitioner had filed their Form GST TRAN 1 on 16.10.2017 under Sections 140(1) and 140(3) of the Goods and Services Tax Act, 2017 (hereinafter called as “GST Act”).

Due to unknown reasons, the credit in entirety sought to be transitioned was not made available forthwith as Input Tax Credit (ITC) on furnishing of Form GST TRAN-1 on 16.10.2017. Further, since the entire amount of Rs.33,87,10,445/- did not reflect in the Electronic Credit Ledger, the petitioner could not file the monthly return in Form GSTR-3B for July 2017 within the due date i.e., 28.08.2023. Such non-filing of Form GSTR-3B for July 2017 had a domino effect and the petitioner was unable to file the GSTR-3B for subsequent months from August, 2017 to December, 2017,unable to file the GSTR-3B for subsequent months from August, 2017 to December, 2017,

After a lapse of around 6 years, the petitioner was visited with a Recovery notice dated 16.05.2023, demanding the payment of interest of a sum of Rs.23,76,26,657/- for alleged belated payment of GST from July, 2017 to December, 2017. The said recovery proceedings were initiated directly even without the issuance of show cause notice.

Even after the filing of a detailed response by the petitioner vide their letter dated 29.05.2023, the recovery proceedings were not withdrawn by the Department and hence, the petitioner challenged the said Recovery notice in W.P.No.16866 of 2023, in which, vide order dated 07.06.2023, this Court had granted stay of recovery proceedings subject to the payment of 30% of the interest amount demanded in the Letter dated 16.05.2023. Aggrieved by the said interim order dated 07.06.2023, the petitioner had preferred an appeal in W.A.No.1263 of 2023 before the Hon’ble Division Bench of this Court.

Observation

As long as the GST, which was collected by a registered person, is credited to the account of the Government not later than the last date for filing the monthly returns, to that extent, the tax liability of such registered person will be discharged from the date when the amount was credited to the account of the Government. If there is any default in payment of GST, even subsequent to the due date for filing the monthly returns i.e., on or before 20 th of every succeeding month, for the said delayed period alone a registered person is liable to pay interest in terms of Section 50(1) of the Act.

In view of the above, impugned letter dated 16.05.2023 bearing DIN 20230559TK00020650 issued by the 1 st respondent impugned order OC.No.77/2023 bearing DIN 20230759TK000000E36E dated 12.07.2023 passed by the 1 st respondent are liable to be quashed. Accordingly, quashed.

Comments

This is very important judgment as there are lot of taxpayers who couldnt file the return in the initial phase. There were many technical glitches on the portal Thus non filing of return itself will not attract the interest in the GST provisions.

Read/download the copy of judgment-

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.