Cancellation of registration set aside by the court – read order

The cancellation of registration was dropped by the honourable high court.

Pleading

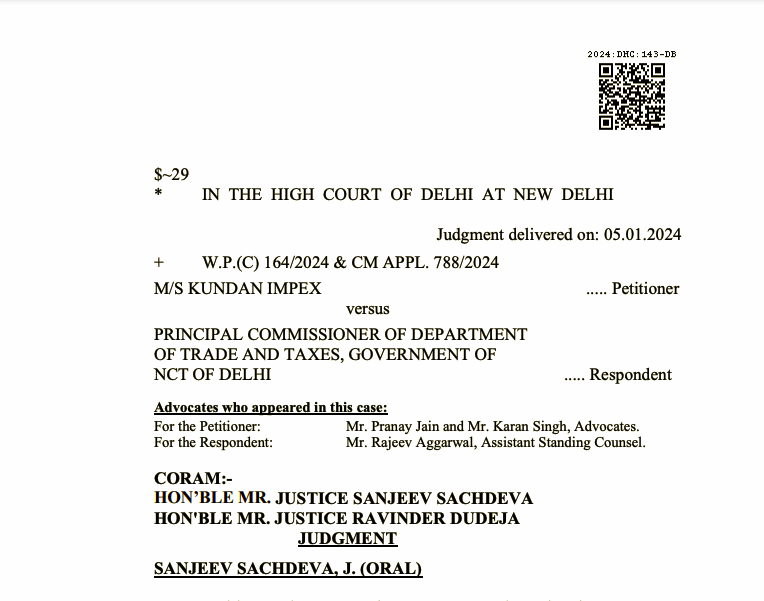

Petitioner impugns show cause notice dated 05.07.2023 whereby the registration of the petitioner has been suspended. Petitioner further seeks a direction to the respondent to cancel the registration of the petitioner from the date when the last return was filed i.e. in July, 2023.

Facts

Petitioner impugns show cause notice dated 05.07.2023 whereby the registration of the petitioner has been suspended. Petitioner further seeks a direction to the respondent to cancel the registration of the petitioner from the date when the last return was filed i.e. in July, 2023.

Observation

Be that as it may, since we have held that the show cause notice does not contain the requisite details, the same is not sustainable and is liable to be quashed and even the letter dated 12.06.2023 does not give any clarity as to the allegation of availing of fraudulent input tax credit by the petitioner. Accordingly, the show cause notice is set aside.

It would be, however, open to the respondent to take further action in accordance with law inter alia, cancellation of registration with retrospective effect. However, the same would be in accordance with law and pursuant to a proper Show Cause Notice and an opportunity of hearing being given to the petitioner.

- With regard to the contention of learned counsel for the petitioner for cancellation of the registration, it would be open to the petitioner to apply for cancellation of registration in accordance with law.

Read/download the judgment-

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.