Penalty in absence of any evasion is bound to drop

Comment

In many judgments it is clarified that there should not be a levy of penalty without an intention to evade tax. In this judgment court again clarified that the penalty should only be levied when there is an intention to evade tax.

One more important thing emphasized by the court is if the E way bill is produced before the order imposing the penalty was passed, It should be fine and no penalty should be levied.

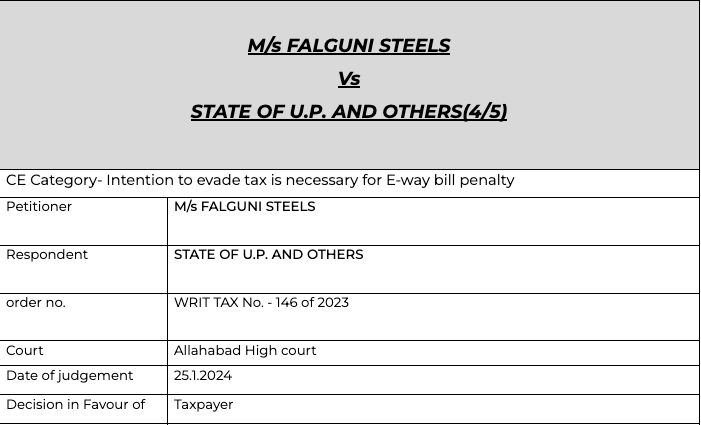

Details of the case

Citations

Modern Traders v. State of UP (Writ Tax No. 762 3 of 2018).

M/s Axpress Logistics India Pvt Ltd. v. Union of India (Writ Tax No. 602 of 2018)

VSL Alloys (India) Pvt. Ltd. v. State of U.P. and Another

M/s. Shyam Sel and Power Ltd. v. State of U.P. and Others

J.K. Cement Ltd. v. State of U.P. and Others

Roli Enterprises v. State of UP and Others

Hindustan Herbal Cosmetics v. State of U.P.

Central Council for Research in Ayurvedic Sciences and Another v. Bikartan Das and Others,

Nagendra Nath Bora and Another v. The Commissioner of Hills Division and Appeal, Assam and Other

Facts

The petitioner alleges that during the relevant time, the e-Way Bill portal of the Department was marred by glitches and technical shortcomings and owing to the said fact, e-Way Bills on several occasions could not be generated by theTransporters/Consignors/Consignees.

- Owing to the above stated glitch, e-Way Bills could not begenerated by the time of the onset of the transportation of the Good. The said e-Way Bills were generated on February 20, 2019 (No.47051859886) and February 21, 2019 (No. 481051862043). The petitioner states that the said e-Way Bills were presented before the Respondent No. 2 at the time of the interception of the goods and before the issuance of the Show Cause Notice as well as passing of the order under Section 129(3) of the Uttar Pradesh Goods and Services Tax Act, 2017 (hereinafter referred to as the ‘UPGST Act, 2017’). However, the said e-way Bills were not taken into consideration by the Respondent No. 2. Show Cause Notice (FORM GST MOV – 07) was issued to the petitioner under Section 129(3) of the UPGST Act, 2017 on February 21, 2019 alleging that the movement of the goods was in contravention to the provisions of the UPGST Act, 2017. The said Show Cause Notice required the petitioner to show cause as to why tax of an amount of INR 1,29,862/- along with an equivalent penalty of INR 1,29,862/- ought not to be recovered from it

Observation

if penalty is imposed, in the presence of all the valid documents, even if e-Way Bill has not been generated, and in the absence of any determination to evade tax, it cannot be sustained.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.